OPEN-SOURCE SCRIPT

Aktualisiert Volume Block Order Analyzer

Core Concept

The Volume Block Order Analyzer is a sophisticated Pine Script strategy designed to detect and analyze institutional money flow through large block trades. It identifies unusually high volume candles and evaluates their directional bias to provide clear visual signals of potential market movements.

How It Works: The Mathematical Model

1. Volume Anomaly Detection

The strategy first identifies "block trades" using a statistical approach:

Pine Script®

This means a candle must have volume exceeding the recent average by a user-defined multiplier (default 2.0x) to be considered a significant block trade.

2. Directional Impact Calculation

For each block trade identified, its price action determines direction:

- Bullish candle (close > open): Positive impact

- Bearish candle (close < open): Negative impact

The magnitude of impact is proportional to the volume size:

Pine Script®

This creates a normalized impact score typically ranging from -1.0 to 1.0, scaled by dividing by 10 to prevent excessive values.

3. Cumulative Impact with Time Decay

The key innovation is the cumulative impact calculation with decay:

Pine Script®

This mathematical model has important properties:

- Recent block trades have stronger influence than older ones

- Impact gradually "fades" at rate determined by decay factor (default 0.95)

- Sustained directional pressure accumulates over time

- Opposing pressure gradually counteracts previous momentum

Trading Logic

Signal Generation

The strategy generates trading signals based on momentum shifts in institutional order flow:

1. Long Entry Signal: When cumulative impact crosses from negative to positive

Pine Script®

*Logic: Institutional buying pressure has overcome selling pressure, indicating potential upward movement*

2. Short Entry Signal: When cumulative impact crosses from positive to negative

Pine Script®

*Logic: Institutional selling pressure has overcome buying pressure, indicating potential downward movement*

3. Exit Logic: Positions are closed when the cumulative impact moves against the position

Pine Script®

*Logic: The original signal is no longer valid as institutional flow has reversed*

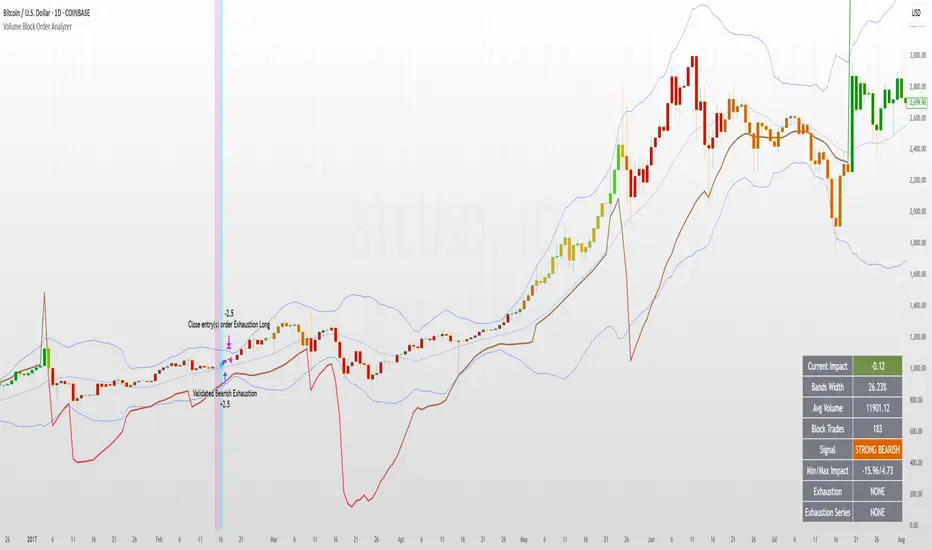

Visual Interpretation System

The strategy employs multiple visualization techniques:

1. Color Gradient Bar System:

- Deep green: Strong buying pressure (impact > 0.5)

- Light green: Moderate buying pressure (0.1 < impact ≤ 0.5)

- Yellow-green: Mild buying pressure (0 < impact ≤ 0.1)

- Yellow: Neutral (impact = 0)

- Yellow-orange: Mild selling pressure (-0.1 < impact ≤ 0)

- Orange: Moderate selling pressure (-0.5 < impact ≤ -0.1)

- Red: Strong selling pressure (impact ≤ -0.5)

2. Dynamic Impact Line:

- Plots the cumulative impact as a line

- Line color shifts with impact value

- Line movement shows momentum and trend strength

3. Block Trade Labels:

- Marks significant block trades directly on the chart

- Shows direction and volume amount

- Helps identify key moments of institutional activity

4. Information Dashboard:

- Current impact value and signal direction

- Average volume benchmark

- Count of significant block trades

- Min/Max impact range

Benefits and Use Cases

This strategy provides several advantages:

1. Institutional Flow Detection: Identifies where large players are positioning themselves

2. Early Trend Identification: Often detects institutional accumulation/distribution before major price movements

3. Market Context Enhancement: Provides deeper insight than simple price action alone

4. Objective Decision Framework: Quantifies what might otherwise be subjective observations

5. Adaptive to Market Conditions: Works across different timeframes and instruments by using relative volume rather than absolute thresholds

Customization Options

The strategy allows users to fine-tune its behavior:

- Volume Threshold: How unusual a volume spike must be to qualify

- Lookback Period: How far back to measure average volume

- Impact Decay Factor: How quickly older trades lose influence

- Visual Settings: Labels and line width customization

This sophisticated yet intuitive strategy provides traders with a window into institutional activity, helping identify potential trend changes before they become obvious in price action alone.

The Volume Block Order Analyzer is a sophisticated Pine Script strategy designed to detect and analyze institutional money flow through large block trades. It identifies unusually high volume candles and evaluates their directional bias to provide clear visual signals of potential market movements.

How It Works: The Mathematical Model

1. Volume Anomaly Detection

The strategy first identifies "block trades" using a statistical approach:

```

avgVolume = ta.sma(volume, lookbackPeriod)

isHighVolume = volume > avgVolume * volumeThreshold

```

This means a candle must have volume exceeding the recent average by a user-defined multiplier (default 2.0x) to be considered a significant block trade.

2. Directional Impact Calculation

For each block trade identified, its price action determines direction:

- Bullish candle (close > open): Positive impact

- Bearish candle (close < open): Negative impact

The magnitude of impact is proportional to the volume size:

```

volumeWeight = volume / avgVolume // How many times larger than average

blockImpact = (isBullish ? 1.0 : -1.0) * (volumeWeight / 10)

```

This creates a normalized impact score typically ranging from -1.0 to 1.0, scaled by dividing by 10 to prevent excessive values.

3. Cumulative Impact with Time Decay

The key innovation is the cumulative impact calculation with decay:

```

cumulativeImpact := cumulativeImpact * impactDecay + blockImpact

```

This mathematical model has important properties:

- Recent block trades have stronger influence than older ones

- Impact gradually "fades" at rate determined by decay factor (default 0.95)

- Sustained directional pressure accumulates over time

- Opposing pressure gradually counteracts previous momentum

Trading Logic

Signal Generation

The strategy generates trading signals based on momentum shifts in institutional order flow:

1. Long Entry Signal: When cumulative impact crosses from negative to positive

```

if ta.crossover(cumulativeImpact, 0)

strategy.entry("Long", strategy.long)

```

*Logic: Institutional buying pressure has overcome selling pressure, indicating potential upward movement*

2. Short Entry Signal: When cumulative impact crosses from positive to negative

```

if ta.crossunder(cumulativeImpact, 0)

strategy.entry("Short", strategy.short)

```

*Logic: Institutional selling pressure has overcome buying pressure, indicating potential downward movement*

3. Exit Logic: Positions are closed when the cumulative impact moves against the position

```

if cumulativeImpact < 0

strategy.close("Long")

```

*Logic: The original signal is no longer valid as institutional flow has reversed*

Visual Interpretation System

The strategy employs multiple visualization techniques:

1. Color Gradient Bar System:

- Deep green: Strong buying pressure (impact > 0.5)

- Light green: Moderate buying pressure (0.1 < impact ≤ 0.5)

- Yellow-green: Mild buying pressure (0 < impact ≤ 0.1)

- Yellow: Neutral (impact = 0)

- Yellow-orange: Mild selling pressure (-0.1 < impact ≤ 0)

- Orange: Moderate selling pressure (-0.5 < impact ≤ -0.1)

- Red: Strong selling pressure (impact ≤ -0.5)

2. Dynamic Impact Line:

- Plots the cumulative impact as a line

- Line color shifts with impact value

- Line movement shows momentum and trend strength

3. Block Trade Labels:

- Marks significant block trades directly on the chart

- Shows direction and volume amount

- Helps identify key moments of institutional activity

4. Information Dashboard:

- Current impact value and signal direction

- Average volume benchmark

- Count of significant block trades

- Min/Max impact range

Benefits and Use Cases

This strategy provides several advantages:

1. Institutional Flow Detection: Identifies where large players are positioning themselves

2. Early Trend Identification: Often detects institutional accumulation/distribution before major price movements

3. Market Context Enhancement: Provides deeper insight than simple price action alone

4. Objective Decision Framework: Quantifies what might otherwise be subjective observations

5. Adaptive to Market Conditions: Works across different timeframes and instruments by using relative volume rather than absolute thresholds

Customization Options

The strategy allows users to fine-tune its behavior:

- Volume Threshold: How unusual a volume spike must be to qualify

- Lookback Period: How far back to measure average volume

- Impact Decay Factor: How quickly older trades lose influence

- Visual Settings: Labels and line width customization

This sophisticated yet intuitive strategy provides traders with a window into institutional activity, helping identify potential trend changes before they become obvious in price action alone.

Versionshinweise

Volume Block Order Analyzer Strategy Description Core Concept

The Volume Block Order Analyzer is a sophisticated Pine Script strategy designed to detect and analyze institutional money flow through large block trades. It identifies unusually high volume candles and evaluates their directional bias to provide clear visual signals of potential market movements.

How It Works: The Mathematical Model

1. Volume Anomaly Detection

The strategy first identifies "block trades" using a statistical approach:

avgVolume = ta.sma(volume, lookbackPeriod)

isHighVolume = volume > avgVolume * volumeThreshold and (minVolumeFilter == 0 or volume >= minVolumeFilter)

This means a candle must have volume exceeding the recent average by a user-defined multiplier (default 2.0x) to be considered a significant block trade, with an optional absolute minimum volume filter.

2. Directional Impact Calculation

For each block trade identified, its price action determines direction:

- Bullish candle (close > open): Positive impact

- Bearish candle (close < open): Negative impact

The magnitude of impact is proportional to the volume size and optionally to price movement:

volumeWeight = volume / avgVolume // How many times larger than average

priceChange = useAbsolutePrice ? math.abs((close - open) / open) * 10 : 1.0

blockImpact = (isBullish ? 1.0 : -1.0) * (volumeWeight / impactNormalization) * priceChange

This creates a normalized impact score typically ranging from -1.0 to 1.0, with user-adjustable normalization parameters.

3. Cumulative Impact with Time Decay

The key innovation is the cumulative impact calculation with decay:

cumulativeImpact := cumulativeImpact * impactDecay + blockImpact

This mathematical model has important properties:

- Recent block trades have stronger influence than older ones

- Impact gradually "fades" at rate determined by decay factor (default 0.95)

- Sustained directional pressure accumulates over time

- Opposing pressure gradually counteracts previous momentum

Trading Logic

Signal Generation

The strategy generates trading signals based on momentum shifts in institutional order flow:

1. Long Entry Signal: When cumulative impact crosses above the signal threshold

if ta.crossover(cumulativeImpact, signalThreshold)

strategy.entry("Long", strategy.long)

Logic: Institutional buying pressure has overcome selling pressure, indicating potential upward movement

2. Short Entry Signal: When cumulative impact crosses below the negative signal threshold

if ta.crossunder(cumulativeImpact, -signalThreshold)

strategy.entry("Short", strategy.short)

Logic: Institutional selling pressure has overcome buying pressure, indicating potential downward movement

3. Exit Logic: Positions are closed when the cumulative impact moves against the position

if cumulativeImpact < -signalThreshold

strategy.close("Long")

Logic: The original signal is no longer valid as institutional flow has reversed

4. Risk Management: Optional trailing stops based on percentage from entry

if useTrailingStop

trailValue = stopPercent / 100 * close

strategy.exit("Stop Long", "Long", trail_offset=trailValue, trail_price=high)

Logic: Protects profits by following price movement at a specified distance

Visual Interpretation System

The strategy employs multiple visualization techniques:

1. Color Gradient Bar System:

- Deep green: Strong buying pressure (impact > 0.5)

- Light green: Moderate buying pressure (0.1 < impact ≤ 0.5)

- Yellow-green: Mild buying pressure (0 < impact ≤ 0.1)

- Yellow: Neutral (impact = 0)

- Yellow-orange: Mild selling pressure (-0.1 < impact ≤ 0)

- Orange: Moderate selling pressure (-0.5 < impact ≤ -0.1)

- Red: Strong selling pressure (impact ≤ -0.5)

2. Dynamic Impact Line:

- Plots the cumulative impact as a line, histogram, or area chart

- Line color shifts with impact value

- Line movement shows momentum and trend strength

- Multiple visualization options available

3. Block Trade Labels:

- Marks significant block trades directly on the chart

- Shows direction and volume amount

- Helps identify key moments of institutional activity

4. Information Dashboard:

- Current impact value and signal direction

- Average volume benchmark

- Count of significant block trades

- Min/Max impact range for context

Benefits and Use Cases

This strategy provides several advantages:

1. Institutional Flow Detection: Identifies where large players are positioning themselves

2. Early Trend Identification: Often detects institutional accumulation/distribution before major price movements

3. Market Context Enhancement: Provides deeper insight than simple price action alone

4. Objective Decision Framework: Quantifies what might otherwise be subjective observations

5. Adaptive to Market Conditions: Works across different timeframes and instruments by using relative volume rather than absolute thresholds

Customization Options

The strategy allows users to fine-tune its behavior with an extensive set of parameters:

Volume Analysis Settings

- Volume Threshold: How unusual a volume spike must be to qualify

- Lookback Period: How far back to measure average volume

- Minimum Volume Filter: Optional absolute minimum volume requirement

Impact Calculation Settings

- Impact Decay Factor: How quickly older trades lose influence

- Impact Normalization Divisor: Controls impact score scaling

- Price Movement Consideration: Option to factor in candle size

Visual Settings

- Bar Coloring Toggle: Enable/disable chart bar coloring

- Impact Line Display: Show/hide the impact line

- Plot Style Selection: Line, Histogram, or Area chart

- Label Controls: Show/hide trade labels

Strategy Settings

- Strategy Enable/Disable: Turn trading signals on/off

- Signal Threshold: Minimum impact required for signals

- Trailing Stop: Optional trailing stop loss protection

- Stop Percentage: Customizable risk management

This sophisticated yet intuitive strategy provides traders with a window into institutional activity, helping identify potential trend changes before they become obvious in price action alone.

Versionshinweise

<think>I need to remove the # symbols from the markdown formatting that I used in my previous response. I should also ensure I'm properly using the and tags for bold text as requested, and that any code snippets are wrapped in and

Core Concept

The Volume Block Order Analyzer is a sophisticated Pine Script strategy designed to detect and analyze institutional money flow through large block trades. It identifies unusually high volume candles and evaluates their directional bias to provide clear visual signals of potential market movements.

How It Works: The Mathematical Model

1. Volume Anomaly Detection

The strategy first identifies "block trades" using a statistical approach:

avgVolume = ta.sma(volume, lookbackPeriod)

isHighVolume = volume > avgVolume * volumeThreshold and (minVolumeFilter == 0 or volume >= minVolumeFilter)

This means a candle must have volume exceeding the recent average by a user-defined multiplier (default 2.0x) to be considered a significant block trade, with an optional absolute minimum volume filter.

2. Directional Impact Calculation

For each block trade identified, its price action determines direction:

- Bullish candle (close > open): Positive impact

- Bearish candle (close < open): Negative impact

The magnitude of impact is proportional to the volume size and optionally to price movement:

volumeWeight = volume / avgVolume // How many times larger than average

priceChange = useAbsolutePrice ? math.abs((close - open) / open) * 10 : 1.0

blockImpact = (isBullish ? 1.0 : -1.0) * (volumeWeight / impactNormalization) * priceChange

This creates a normalized impact score typically ranging from -1.0 to 1.0, with user-adjustable normalization parameters.

3. Cumulative Impact with Time Decay

The key innovation is the cumulative impact calculation with decay:

cumulativeImpact := cumulativeImpact * impactDecay + blockImpact

This mathematical model has important properties:

- Recent block trades have stronger influence than older ones

- Impact gradually "fades" at rate determined by decay factor (default 0.95)

- Sustained directional pressure accumulates over time

- Opposing pressure gradually counteracts previous momentum

Trading Logic

Signal Generation

The strategy generates trading signals based on momentum shifts in institutional order flow:

1. Long Entry Signal: When cumulative impact crosses above the signal threshold

if ta.crossover(cumulativeImpact, signalThreshold)

strategy.entry("Long", strategy.long)

Logic: Institutional buying pressure has overcome selling pressure, indicating potential upward movement

2. Short Entry Signal: When cumulative impact crosses below the negative signal threshold

if ta.crossunder(cumulativeImpact, -signalThreshold)

strategy.entry("Short", strategy.short)

Logic: Institutional selling pressure has overcome buying pressure, indicating potential downward movement

3. Exit Logic: Positions are closed when the cumulative impact moves against the position

if cumulativeImpact < -signalThreshold

strategy.close("Long")

Logic: The original signal is no longer valid as institutional flow has reversed

4. Risk Management: Optional trailing stops based on percentage from entry

if useTrailingStop

trailValue = stopPercent / 100 * close

strategy.exit("Stop Long", "Long", trail_offset=trailValue, trail_price=high)

Logic: Protects profits by following price movement at a specified distance

Visual Interpretation System

The strategy employs multiple visualization techniques:

1. Color Gradient Bar System:

- Deep green: Strong buying pressure (impact > 0.5)

- Light green: Moderate buying pressure (0.1 < impact ≤ 0.5)

- Yellow-green: Mild buying pressure (0 < impact ≤ 0.1)

- Yellow: Neutral (impact = 0)

- Yellow-orange: Mild selling pressure (-0.1 < impact ≤ 0)

- Orange: Moderate selling pressure (-0.5 < impact ≤ -0.1)

- Red: Strong selling pressure (impact ≤ -0.5)

2. Dynamic Impact Line:

- Plots the cumulative impact as a line, histogram, or area chart

- Line color shifts with impact value

- Line movement shows momentum and trend strength

- Multiple visualization options available

3. Block Trade Labels:

- Marks significant block trades directly on the chart

- Shows direction and volume amount

- Helps identify key moments of institutional activity

4. Information Dashboard:

- Current impact value and signal direction

- Average volume benchmark

- Count of significant block trades

- Min/Max impact range for context

Benefits and Use Cases

This strategy provides several advantages:

1. Institutional Flow Detection: Identifies where large players are positioning themselves

2. Early Trend Identification: Often detects institutional accumulation/distribution before major price movements

3. Market Context Enhancement: Provides deeper insight than simple price action alone

4. Objective Decision Framework: Quantifies what might otherwise be subjective observations

5. Adaptive to Market Conditions: Works across different timeframes and instruments by using relative volume rather than absolute thresholds

Customization Options

The strategy allows users to fine-tune its behavior with an extensive set of parameters:

Volume Analysis Settings

- Volume Threshold: How unusual a volume spike must be to qualify

- Lookback Period: How far back to measure average volume

- Minimum Volume Filter: Optional absolute minimum volume requirement

Impact Calculation Settings

- Impact Decay Factor: How quickly older trades lose influence

- Impact Normalization Divisor: Controls impact score scaling

- Price Movement Consideration: Option to factor in candle size

Visual Settings

- Bar Coloring Toggle: Enable/disable chart bar coloring

- Impact Line Display: Show/hide the impact line

- Plot Style Selection: Line, Histogram, or Area chart

- Label Controls: Show/hide trade labels

Strategy Settings

- Strategy Enable/Disable: Turn trading signals on/off

- Signal Threshold: Minimum impact required for signals

- Trailing Stop: Optional trailing stop loss protection

- Stop Percentage: Customizable risk management

This sophisticated yet intuitive strategy provides traders with a window into institutional activity, helping identify potential trend changes before they become obvious in price action alone.

Versionshinweise

Core Purpose: The Volume Block Order Analyzer identifies and tracks significant volume events (institutional buying/selling) to reveal hidden market dynamics.Main Features:

1. Volume Block Detection

- Identifies bars with volume exceeding the average by your chosen threshold

- Distinguishes between bullish (buying) and bearish (selling) blocks

- Filters out insignificant volume using minimum volume filter

2. Cumulative Impact Calculation

- Maintains a running score of volume block effects with time decay

- Provides directional bias information through the Impact Line

- Calculates proportional impact based on volume weight relative to average

3. Advanced Visualization System

- Bar coloring with 7 distinct impact levels (Extreme/Strong/Mild Bullish/Bearish + Equilibrium)

- Impact line with customizable style (Line/Histogram/Area)

- Intuitive signal labels on significant block trades

- Comprehensive information table with current readings

4. RSI Price Projection

- Maps RSI (0-100) directly onto price chart within deviation bands

- Visual overlay showing RSI movement in context of price action

- Optional reference levels for overbought/oversold conditions

5. Standard Deviation Bands

- Shows market volatility through adjustable deviation bands

- Provides context for price movements and expected ranges

- Acts as boundary framework for RSI projection

6. Automated Trading Strategy

- Entry signals based on cumulative impact crossing thresholds

- Position management with impact-based exits

- Optional trailing stop functionality

7. Information Display

- Detailed table showing all key metrics

- Color-coded impact level with descriptive labels

- Optional help legend explaining all readings

8. Signal Negation System

- Prevents conflicting signals within the lookback period

- Applies logical negation between buy and sell signals

- Increases signal quality by reducing contradictory indications

Technical Explanation:

Volume Analysis:

The script uses

ta.sma(volume, lookbackPeriod)

volume > avgVolume * volumeThreshold

blockImpact = (isBullish ? 1 : -1) * (volumeWeight / impactNormalization) * priceChange

Impact Accumulation:

The core formula for maintaining the cumulative impact is:

cumulativeImpact := cumulativeImpact * impactDecay + blockImpact

This weighted sum gives greater importance to recent activity while allowing older impacts to gradually fade, simulating how institutional activity influences price over time.

Signal Negation:

The indicator tracks recent signals and cancels contradictory ones using:

if isValidBuySignal and array.size(sellSignals) > 0

isValidBuySignal := false // Negate buy if recent sell exists

array.clear(sellSignals) // Clear sells as they're now negated by this buy

Color Classification:

The script classifies the current market state into 7 categories:

- Extreme Bullish (> 0.5)

- Strong Bullish (0.1 to 0.5)

- Mild Bullish (0 to 0.1)

- Equilibrium (= 0)

- Mild Bearish (-0.1 to 0)

- Strong Bearish (-0.5 to -0.1)

- Extreme Bearish (< -0.5)

Benefits for Traders:

1. Institutional Flow Insight

- Reveals where significant money is entering or exiting positions

- Distinguishes between retail noise and meaningful institutional activity

- Identifies accumulation and distribution phases

2. Enhanced Decision Making

- Provides objective volume-based evidence for trade decisions

- Shows developing trends before price fully confirms them

- Helps determine appropriate position sizing based on strength of signals

3. Context-Rich Analysis

- Combines price action, volume, and momentum in one unified view

- Shows relationships between volatility, momentum and volume

- Offers clear visual cues that work across different timeframes

4. Adaptable to Trading Style

- Works for both trend following and reversal strategies

- Effective for day trading through position trading

- Custom thresholds allow sensitivity adjustment for different markets

5. Reduced Signal Noise

- Negation system prevents whipsaws from conflicting signals

- Intuitively placed labels enhance visual clarity

- Helps maintain focus on dominant volume forces

User Customization:

1. Volume Detection Settings

- Adjustable volume threshold multiplier

- Custom lookback period for average calculation

- Minimum volume filter to ignore small bars

2. Impact Calculation Settings

- Decay factor controls how quickly old impacts fade

- Normalization divisor adjusts impact score magnitude

- Optional price movement size consideration

3. Visual Preferences

- Fully customizable colors for all 7 impact levels

- Three impact plot styles (Line/Histogram/Area)

- Toggleable components (bar colors, labels, impact line)

4. Trading Parameters

- Adjustable signal threshold for strategy entries

- Optional trailing stop with percentage-based distance

- Strategy can be disabled for analysis-only use

Using the Information:

Current Impact: Shows the current cumulative effect of volume blocks. Values further from zero indicate stronger bullish/bearish pressure. The color indicates which of the 7 impact categories is active.

RSI Value: Current RSI reading (0-100). This appears both in the info table and visualized on the price chart when enabled.

Bands Width: Shows volatility as a percentage of price. Higher values indicate increased volatility in the market.

Avg Volume: The baseline volume used to detect significant blocks. Derived from the selected lookback period.

Block Trades: Total count of significant volume events detected since chart beginning.

Min/Max Impact: Historical extremes that provide context for current readings and used for color scaling.

Best Practices:

1. Start with default settings, then adjust volume threshold based on your instrument's characteristics

2. The impact line crossing zero often precedes trend changes

3. Extreme readings can indicate potential reversal points

4. Use the information table to quickly assess current market conditions

5. Enable the Information Legend when first learning the indicator

6. Consider both the impact color and the count of block trades when evaluating signal strength

// User Contributions Welcome

Share Your Feedback:

This indicator is continuously evolving based on user feedback. If you have suggestions for improvements, new features, or encounter any issues, please share them in the comments. Your input helps make this tool more valuable for the entire trading community!

Happy Trading!

Versionshinweise

VOLUME BLOCK ANALYZER - OVERVIEWSCRIPT OVERVIEW

The Volume Block Analyzer is an advanced technical analysis tool that identifies significant market volume blocks and calculates their cumulative impact on price action. It excels at detecting potential exhaustion points in trends and generating trading signals based on volume-price relationships.

KEY FEATURES

1. ADVANCED VOLUME BLOCK DETECTION

The script identifies significant volume blocks by comparing current volume to historical averages:

isHighVolume = volume > avgVolume * volumeThreshold and (minVolumeFilter == 0 or volume >= minVolumeFilter)

Volume blocks are classified as bullish or bearish based on price action:

isBullish = close > open

isBearish = close < open

2. CUMULATIVE IMPACT CALCULATION

One of the script's core features is the innovative cumulative impact system that:

- Assigns an impact score to each volume block based on its size and direction

- Applies a decay factor to gradually reduce the influence of older blocks

- Normalizes impact values for consistent visualization

blockImpact = 0.0

if isHighVolume

volumeWeight = volume / avgVolume

if isBullish

blockImpact := 1.0 * (volumeWeight / impactNormalization) * priceChange

else if isBearish

blockImpact := -1.0 * (volumeWeight / impactNormalization) * priceChange

cumulativeImpact := cumulativeImpact * impactDecay + blockImpact

3. EXHAUSTION DETECTION SYSTEM

The script features sophisticated exhaustion detection logic that identifies potential reversal points by:

- Tracking consecutive bars in the same direction

- Monitoring price movement constraints

- Implementing a cooling-off period to prevent false signals

- Detecting invalidation of exhaustion conditions

isBearishExhaustion := detectExhaustion and cumulativeImpact < -EXTREME_THRESHOLD and

consecutiveNeutralOrBearish >= exhaustionBarsThreshold and

priceRangePercent <= exhaustionPriceThreshold and

barsSinceLastBearishInvalidation >= minimumBarsBeforeNewExhaustion and

not bearishExhaustionInvalidated

4. BREAKOUT SIGNAL GENERATION

The system detects breakouts when exhaustion patterns are invalidated:

// Handle invalidation immediately

if bearishExhaustionInvalidated and previousBearishExhaustion

newBearishBreakout := true

// Immediately reset all exhaustion state and counters

5. STANDARD DEVIATION BANDS

The script calculates and displays standard deviation bands that:

- Provide context for price movement

- Serve as reference points for impact visualization

- Help identify abnormal price behavior

basis = ta.sma(bandsSource, bandsPeriod)

dev = ta.stdev(bandsSource, bandsPeriod)

upperBand = basis + bandsMultiplier * dev

lowerBand = basis - bandsMultiplier * dev

6. COMPLETE TRADING STRATEGY

The script includes a fully-featured trading strategy with:

- Impact crossover entries

- Exhaustion-based signals

- Breakout signals

- Trend protection filters

- Trailing stop loss mechanism

// Entry signals with threshold filter and trend protection

if ta.crossover(cumulativeImpact, signalThreshold) and canBuySignal

strategy.entry("Long", strategy.long)

if useBreakoutSignals

// When bearish exhaustion is invalidated, go short

if newBearishBreakout and canSellSignal

strategy.entry("Breakout Short", strategy.short, comment="Bearish Exhaustion Breakout", qty=breakoutPositionSize)

7. ENHANCED VISUAL FEEDBACK

The script provides rich visual feedback through:

- Color-coded bars based on impact levels

- Impact line visualization (line, histogram, or area)

- Exhaustion highlighting with background colors

- Breakout signals with distinct visuals

- Comprehensive information dashboard

BENEFITS FOR TRADERS

REVEALING HIDDEN MARKET PRESSURE

By tracking cumulative impact of volume blocks, the script reveals underlying buying and selling pressure that may not be apparent from price action alone.

EARLY WARNING SYSTEM

The exhaustion detection mechanism serves as an early warning system for potential reversals, helping traders identify when a trend may be losing steam despite continued price movement.

SIGNAL FILTERING WITH COOLING-OFF PERIOD

The implementation of a minimum bar count between signals reduces noise and prevents excessive signal generation after invalidation events.

ADVANCED BREAKOUT DETECTION

Rather than relying solely on traditional breakout methods, the script identifies breakouts specifically when exhaustion patterns are invalidated, providing context-aware signals.

COMPLETE STRATEGY FRAMEWORK

Beyond just an indicator, the script provides a complete trading strategy framework with entries, exits, position sizing, and risk management tools.

HIGHLY CUSTOMIZABLE

With over 40 customizable parameters organized into logical groups, traders can fine-tune the script to match their specific trading style and market conditions.

KEY PARAMETER GROUPS

VOLUME ANALYSIS SETTINGS

Control volume threshold, lookback period, and minimum filters

IMPACT CALCULATION SETTINGS

Adjust decay factor, normalization, and extreme value handling

EXHAUSTION DETECTION SETTINGS

Configure bars threshold, price constraints, and cooling-off periods

STRATEGY SETTINGS

Manage entries, exits, trend protection, and stop losses

VISUAL SETTINGS

Customize the display of all visual elements and information panels

CONCLUSION

The Volume Block Analyzer combines sophisticated volume analysis with momentum tracking and exhaustion detection to create a powerful toolset for traders. Its strength lies in revealing the underlying forces driving price action and identifying potential exhaustion points before they become obvious in price charts.

The script's cooling-off system between signals ensures you receive meaningful alerts when they matter most, while the exhaustion invalidation detection helps identify high-probability breakout opportunities in a systematic way.

Versionshinweise

[h1]VolumeBlockAnalyzer Changelog[/h1][h2]Exhaustion Validation Logic[/h2]

Modified exhaustion validation to properly generate signals and maintain state:

// Bearish Exhaustion Validation (generates LONG entry)

bool bearishExhaustionValidated = isBearishExhaustion and not na(bearishExhaustionFirstHigh) and high > bearishExhaustionFirstHigh

// Bullish Exhaustion Validation (generates SHORT entry)

bool bullishExhaustionValidated = isBullishExhaustion and not na(bullishExhaustionFirstLow) and low < bullishExhaustionFirstLow

Benefit: Clearer signal generation exactly when price validates an exhaustion pattern.

[h2]Entry Signal Generation[/h2]

Updated entry logic to generate signals on validation bars:

if bearishExhaustionValidated

validatedBearishExhaustion := true

if useExhaustionSignals and canBuySignal

strategy.entry("Exhaustion Long", strategy.long, comment="Validated Bearish Exhaustion", qty=exhaustionPositionSize)

if bullishExhaustionValidated

validatedBullishExhaustion := true

if useExhaustionSignals and canSellSignal

strategy.entry("Exhaustion Short", strategy.short, comment="Validated Bullish Exhaustion", qty=exhaustionPositionSize)

Benefit: Immediate entry signals when exhaustion patterns are validated by price action.

[h2]Exhaustion State Management[/h2]

Improved state tracking for exhaustion patterns:

// Variables for exhaustion series tracking

var bool validatedBearishExhaustion = false

var bool validatedBullishExhaustion = false

var float firstBullishExhaustionBarLow = na

var float firstBearishExhaustionBarHigh = na

Benefit: Better tracking of exhaustion states and validation points.

[h2]Visual Indicators[/h2]

Enhanced visual feedback for exhaustion patterns:

// Background color for active exhaustion or validation

if isBearishExhaustion and not bearishExhaustionInvalidated

bgcolorValue := color.new(exhaustionBearishColor, 70)

else if validatedBearishExhaustion

bgcolorValue := color.new(exhaustionBullishColor, 70) // Use bullish color for long entry

// Labels for validation

label.new(x=bar_index, y=low, text="BEARISH EXHAUSTION VALIDATED - LONG ENTRY ↑")

label.new(x=bar_index, y=high, text="BULLISH EXHAUSTION VALIDATED - SHORT ENTRY ↓")

Benefit: Clear visual indication of active exhaustion patterns and their validation points.

[h2]Invalidation Handling[/h2]

Improved invalidation logic to properly handle pattern failures:

if bearishExhaustionInvalidated and previousBearishExhaustion

// Completely remove all exhaustion state and labeling

isBearishExhaustion := false

bearishExhaustionFirstBar := 0

bearishExhaustionFirstHigh := na

consecutiveBearishExhaustionBars := 0

validBearishExhaustionSeries := false

Benefit: Cleaner handling of invalidated patterns without generating false signals.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.