PROTECTED SOURCE SCRIPT

Trading/ Range Tracker Advanced -> PROFABIGHI_CAPITAL Strategy

🌟 Overview

The Trading/Range Tracker Advanced Strategy is a fully automated swing breakout trading system that combines impulsive candle filtering, multi-channel range/trend detection, and EMA confirmation for systematic trade execution. It features ATR-based market regime classification, separate swing detection for entries and risk placement, dual-mode EMA frameworks, and comprehensive performance metrics for backtesting optimization.

⚙️ Strategy Configuration

- Initial Capital: Starting equity for backtest simulation

- Slippage: Execution slippage modeling for realistic results

- Position Sizing: Percentage of equity allocated per trade

- Pyramiding Disabled: Prevents multiple entries in same direction

- Order Processing: Executes trades on bar close for confirmed signals

- Zero Margin: No leverage applied to long or short positions

📅 Date Range Settings

- Date Filter Toggle: Enable or disable backtesting time restrictions

- Start Date Selection: Specify beginning date for strategy evaluation

- Full Historical Option: Disable filter to test across entire chart history

- In-Range Condition: Ensures trades only execute within specified timeframe

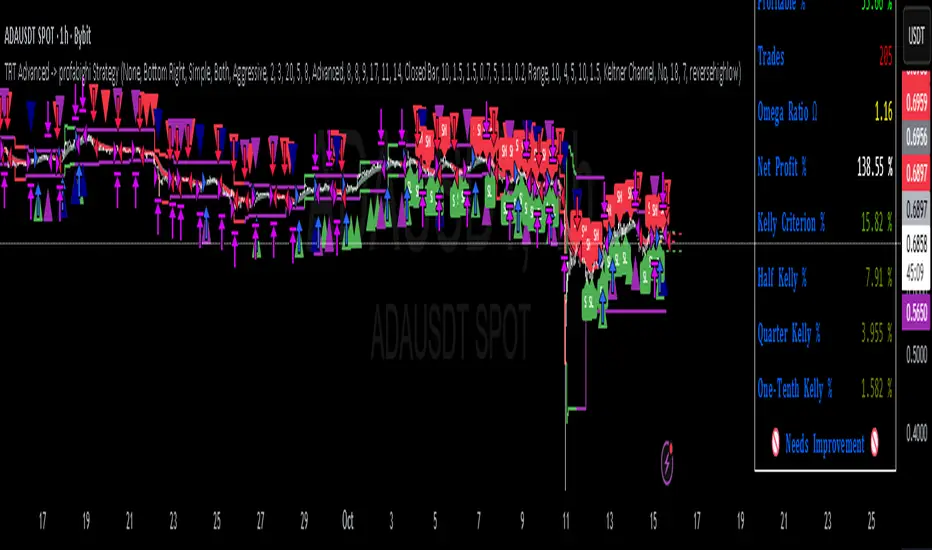

📊 PROFABIGHI_CAPITAL Metrics Display

Performance Curve Options:

- Strategy Equity: Total account value including open positions

- Equity Only: Closed position equity excluding open trades

- Open Profit: Current unrealized profit or loss

- Gross Profit: Total winning trade value before costs

- Net Profit: Final profit after all costs and losses

- None: Hide performance curve display

Metrics Table Configuration:

- Table Position: Place metrics in any screen quadrant or center

- Full Table: Comprehensive statistics including win rate, drawdown, profit factor

- Simple Table: Essential metrics only for minimal display

- None: Hide table for clean chart visualization

⚙️ Mode and Style Settings

- Trading Mode Selection: Choose between long-only, short-only, or bidirectional trading

- Trade Style Configuration: Conservative mode (single position) or Aggressive mode (concurrent trades)

- Sniper Mode Toggle: Require impulsive candles for entries or allow relaxed breakout entries

- Execution Flexibility: Adapt strategy behavior to market conditions and risk appetite

📊 Swing Detection Settings

- Left Bar Lookback: Number of bars before pivot for swing high/low identification

- Right Bar Confirmation: Number of bars after pivot to validate swing structure

- Line Extension Length: Visual display duration for swing level reference lines

- Body-Based Pivots: Uses candle body extremes rather than wicks for cleaner structure

📊 Interim High/Low Detection

Separate SL/TP Calculation Framework:

- Independent Pivot Detection: Dedicated left and right bar parameters for stop loss reference

- Interim Left Bars: Lookback for identifying recent swing extremes

- Interim Right Bars: Confirmation period for interim pivot validation

- Last Candle Tracking: Continuously updates most recent opposing candle body levels

- Dual Reference System: Combines interim pivots with last opposing candle for tighter stops

Risk Placement Logic:

- Long trades use last negative bar low (red candle body low) or interim swing low

- Short trades use last positive bar high (green candle body high) or interim swing high

- Provides more reactive stop placement than main swing levels

📈 EMA Trend Confirmation System

Basis Mode:

- Single pair of short and long EMAs for unified trend determination

- Consistent trend reading across both long and short trade directions

- Simplified decision framework with one trend reference

Advanced Mode:

- Dedicated EMA pairs for long trend detection with separate parameters

- Independent EMA pairs for short trend detection with different periods

- Direction-specific validation for enhanced precision

- Greater flexibility in asymmetric market conditions

EMA Exit Trigger Options:

- Intrabar: Exit signal triggers in real-time during bar formation

- Closed Bar: Exit signal only confirmed at bar close for reduced false exits

⚡ Impulsive Candle Detection

Multi-Factor Validation:

- Size Multiplier: Candle range must exceed average true range by adjustable factor

- Volume Multiplier: Trading volume must exceed average volume by configurable threshold

- Body-to-Wick Ratio: Candle body must represent minimum percentage of total range

- Volume Check Toggle: Optional volume validation (disable for crypto tickers with unreliable volume)

Application in Strategy:

- Breakout Validation: Impulsive candles indicate strong momentum behind swing breaks

- Entry Window: Time-limited entry opportunity after impulsive breakout (adjustable bar count)

- Sniper Mode Filter: When enabled, entries only permitted on impulsive candle breakouts

- Visual Highlighting: Orange bar coloring for impulsive candles outside active trades

🎨 Color Customization

- EMA UpTrend Color: Green color for bullish EMA alignment in Basis mode

- EMA DownTrend Color: Red color for bearish EMA alignment in Basis mode

- Swing Line Color: Yellow for interim high/low reference lines

- Stop Loss Color: Red dashed lines showing risk levels

- Take Profit Color: Green dashed lines showing target levels

- Impulsive Candle Color: Orange bar highlighting when impulse detected

🛡️ Risk Management Framework

- Risk/Reward Ratio Configuration: Adjustable profit target multiplier (default 2.2:1)

- Stop Loss Offset Percentage: Buffer applied to interim swing levels for execution safety

- Long Stop Placement: Below last negative bar low or interim swing low with offset

- Short Stop Placement: Above last positive bar high or interim swing high with offset

- Dynamic Target Calculation: Take profit automatically derived from entry and stop distance

- Offset Protection: Prevents stops too close to structure for stop-hunting protection

📊 Detector Decision Filter

Market Condition Filtering:

- Range Mode: Strategy only executes in ranging market conditions

- Trending Mode: Strategy only executes in trending markets (up or down)

- Off Mode: No market condition filter applied (original behavior)

Conditional Execution:

- Swing high/low detection only active when condition matches

- Entry signals only generated when market regime matches selected filter

- Visual swing labels (SH/SL) only displayed during matching conditions

📈 Trend Range Identifier V2

ATR-Based Trend Detection:

- ATR Length: Period for Average True Range calculation in trend analysis

- ATR Multiplier Trend: Multiplier for trend continuation levels (tighter bands)

- ATR Multiplier Reverse: Multiplier for trend reversal levels (wider bands)

- Asymmetric Bands: Different multipliers create adaptive channel width based on trend direction

Range Detection Parameters:

- Range Length: Lookback period for range channel calculation

- Standard Deviation: Multiplier for channel band width

- Channel Type Selection: Choose between Keltner Channel, Bollinger Bands, or Donchian Channel

Supertrend Integration:

- Supertrend Length: Period for Supertrend indicator calculation

- Supertrend Multiplier: ATR multiplier for Supertrend bands

- Crossover Type Selection: Choose price crossover method (close, highlow, reversehighlow, supertrend)

Channel Display Options:

- Yes: Always show channel bands regardless of market condition

- No: Hide channel bands completely

- Range: Only display channel when market is in range condition

📊 Market Regime Classification

Three-State System:

- Trending Up: Price crosses above upper ATR band and maintains upward momentum

- Trending Down: Price crosses below lower ATR band and maintains downward pressure

- Range: Price oscillates between bands without breaking trend thresholds

Trend Logic Framework:

- Accumulative Trend Tracking: Counts consecutive bars in trend for strength measurement

- Line Compression Detection: Range condition identified when bands narrow over lookback period

- Directional Crossover: Trend initiated when price crosses adaptive ATR levels

- Supertrend Confirmation: Optional supertrend-based crossover validation

Visual Indicators:

- UpLine and DownLine: Color-coded step lines (green for uptrend, red for downtrend, purple for range)

- Channel Bands: Teal-colored upper and lower bands with semi-transparent fill

- Candle Coloring: Silver candles during range conditions when showRange enabled

🎯 Entry Signal Generation

Long Entry Requirements:

- Price breaks above last swing high

- Impulsive candle present (if Sniper Mode enabled)

- EMA trend bullish (short EMA above long EMA or long-specific EMAs aligned)

- Within entry window after breakout (adjustable bar count)

- Market condition matches Detector Decision filter

- Mode permits long trades

- Not already in long position (if Conservative mode)

Short Entry Requirements:

- Price breaks below last swing low

- Impulsive candle present (if Sniper Mode enabled)

- EMA trend bearish (short EMA below long EMA or short-specific EMAs aligned)

- Within entry window after breakout

- Market condition matches Detector Decision filter

- Mode permits short trades

- Not already in short position (if Conservative mode)

Breakout Memory System:

- Breakout Tracking: System remembers when swing levels are breached

- Bar Counting: Tracks bars elapsed since breakout for entry window validation

- Breakout Reset: New swing formation invalidates previous breakout signals

- Entry Window Expiration: Breakout must confirm with EMA within specified bar count

📤 Exit Management Logic

Stop Loss Exit:

- Long position: price touches or crosses below calculated stop level

- Short position: price touches or crosses above calculated stop level

- Strategy closes position immediately on stop hit

Take Profit Exit:

- Long position: price reaches calculated target based on risk/reward ratio

- Short position: price reaches calculated target below entry

- Strategy closes position immediately on target hit

EMA Reversal Exit:

- Basis Mode: Short EMA crosses below long EMA (long exit) or above (short exit)

- Advanced Mode: Direction-specific EMA pair crosses against trade direction

- Intrabar Trigger: Exit in real-time when EMA condition met (if selected)

- Closed Bar Trigger: Exit only after bar confirms (if selected)

- Profit/Loss Classification: Exit marked as profit if price favorable to entry, else loss

Position State Management:

- Trade flags reset after exit

- Conservative mode re-enables entries for both directions

- Breakout conditions cleared after exit

- Stop and target lines deleted from chart

🎨 Visualization Features

Entry and Exit Markers:

- Long Entry Arrows: Green triangles below bars

- Short Entry Arrows: Red triangles above bars

- Profit Exit Markers: Dark blue triangles showing successful exits

- Loss Exit Markers: Purple triangles showing stopped trades

Swing Structure Lines:

- Swing High Lines: Yellow dashed horizontal lines with "SH" labels

- Swing Low Lines: Yellow dashed horizontal lines with "SL" labels

- Stop Loss Lines: Red dashed lines extending forward from entry

- Take Profit Lines: Green dashed lines showing target levels

EMA Trend Lines:

- Basis Mode EMAs: Color-coded for trend (green bullish, red bearish)

- Advanced Mode EMAs: Separate long EMAs (green/gray) and short EMAs (red/gray)

- Dynamic Coloring: Gray when EMA pair not in alignment

Trend Range Visualization:

- UpLine/DownLine: Thick step lines showing ATR-based trend levels (green/red/purple)

- Channel Bands: Upper and lower range boundaries with teal fill

- Conditional Display: Channel only shown based on showChannel setting

Trade Candle Coloring:

- Active Long Position: Green candles during long trade

- Active Short Position: Red candles during short trade

- Range Condition: Silver candles when market in range mode

- Impulsive Highlight: Orange bar color when impulsive candle detected outside trades

📈 Strategy Execution Framework

Entry Execution:

- Long Entry: strategy.entry() called when long signal confirms on bar close

- Short Entry: strategy.entry() called when short signal confirms on bar close

- Date Range Validation: Only executes if within backtesting date range

- Bar Confirmation: Uses barstate.isconfirmed to avoid repainting

Exit Execution:

- Position Closure: strategy.close() called on profit, loss, or EMA reversal exits

- Immediate Execution: Exits processed on same bar as exit condition

- Date Range Check: Continues to manage positions even outside date range

- Bar Confirmation: Exits confirmed at bar close for consistency

Position Management:

- Conservative Mode: Blocks new entries until current position closed

- Aggressive Mode: Allows multiple concurrent positions (pyramiding disabled in settings)

- Direction Blocking: Long entry exits shorts, short entry exits longs

- Trade State Tracking: Boolean flags track active position status

🔔 Alert System

- Long entry alerts with ticker and timeframe

- Short entry alerts with ticker and timeframe

- Stop loss hit alerts (combined for both directions)

- Take profit hit alerts (combined for both directions)

- Long EMA exit alerts

- Short EMA exit alerts

- Impulsive candle detection alerts

🔍 Advanced Features[/b>

Dual Swing Detection:

- Primary Swing Detection: Identifies breakout levels for entry signals

- Interim Swing Detection: Separate parameters for tighter stop loss placement

- Independent Configuration: Each detection system uses own left/right bar settings

- Last Candle Fallback: Uses most recent opposing candle if interim pivot not found

Adaptive ATR Bands:

- Directional Multipliers: Different ATR multiples for continuation vs reversal

- Trend Strength Tracking: Accumulative counter measures bars in trend

- Line Compression Logic: Range detected when bands narrow over specified period

- Crossover Flexibility: Multiple price/indicator crossover methods available

Channel Type Variations:

- Keltner Channel: ATR-based bands for volatility-adjusted ranges

- Bollinger Bands: Standard deviation-based statistical boundaries

- Donchian Channel: High/low range extremes for breakout context

- Unified Interface: Same function handles all channel types

Supertrend Integration:

- Direction Variable: Supertrend state (1 or -1) influences trend calculations

- Optional Crossover: Can use supertrend rather than price for trend triggers

- Combined Logic: Supertrend works with ATR bands for robust regime detection

Performance Optimization:

- Process Orders on Close: Prevents lookahead bias in backtesting

- Confirmed Signals Only: Uses barstate.isconfirmed for all entries/exits

- Slippage Modeling: Includes realistic execution costs

- Zero Pyramiding: Prevents position size inflation

✅ Key Takeaways

- Fully Automated Strategy: Complete execution system with entries, stops, and targets

- Dual Swing Framework: Separate detection for breakouts and risk placement

- ATR-Based Regime Filter: Three-state market classification (trending up/down/range)

- Multi-Channel Options: Choose between Keltner, Bollinger, or Donchian for range detection

- Impulsive Candle Filtering: Optional Sniper Mode ensures entries on momentum candles

- Flexible EMA Framework: Basis mode simplicity or Advanced mode direction-specific optimization

- Adaptive Risk Placement: Uses interim swings and last opposing candles for tighter stops

- Entry Window Control: Time-limited opportunity after breakouts prevents late entries

- Market Condition Filtering: Trade only in preferred environments (range, trending, or both)

- Comprehensive Metrics: Built-in performance analysis with PROFABIGHI_CAPITAL library

- Conservative vs Aggressive: Position management adapts to risk preference

- Multi-Exit Logic: Combines fixed targets with dynamic EMA-based exits

- Backtesting Ready: Date range filtering and confirmed signals prevent repainting

- Visual Trade Tracking: Color-coded candles, lines, and markers show complete trade lifecycle

The Trading/Range Tracker Advanced Strategy is a fully automated swing breakout trading system that combines impulsive candle filtering, multi-channel range/trend detection, and EMA confirmation for systematic trade execution. It features ATR-based market regime classification, separate swing detection for entries and risk placement, dual-mode EMA frameworks, and comprehensive performance metrics for backtesting optimization.

⚙️ Strategy Configuration

- Initial Capital: Starting equity for backtest simulation

- Slippage: Execution slippage modeling for realistic results

- Position Sizing: Percentage of equity allocated per trade

- Pyramiding Disabled: Prevents multiple entries in same direction

- Order Processing: Executes trades on bar close for confirmed signals

- Zero Margin: No leverage applied to long or short positions

📅 Date Range Settings

- Date Filter Toggle: Enable or disable backtesting time restrictions

- Start Date Selection: Specify beginning date for strategy evaluation

- Full Historical Option: Disable filter to test across entire chart history

- In-Range Condition: Ensures trades only execute within specified timeframe

📊 PROFABIGHI_CAPITAL Metrics Display

Performance Curve Options:

- Strategy Equity: Total account value including open positions

- Equity Only: Closed position equity excluding open trades

- Open Profit: Current unrealized profit or loss

- Gross Profit: Total winning trade value before costs

- Net Profit: Final profit after all costs and losses

- None: Hide performance curve display

Metrics Table Configuration:

- Table Position: Place metrics in any screen quadrant or center

- Full Table: Comprehensive statistics including win rate, drawdown, profit factor

- Simple Table: Essential metrics only for minimal display

- None: Hide table for clean chart visualization

⚙️ Mode and Style Settings

- Trading Mode Selection: Choose between long-only, short-only, or bidirectional trading

- Trade Style Configuration: Conservative mode (single position) or Aggressive mode (concurrent trades)

- Sniper Mode Toggle: Require impulsive candles for entries or allow relaxed breakout entries

- Execution Flexibility: Adapt strategy behavior to market conditions and risk appetite

📊 Swing Detection Settings

- Left Bar Lookback: Number of bars before pivot for swing high/low identification

- Right Bar Confirmation: Number of bars after pivot to validate swing structure

- Line Extension Length: Visual display duration for swing level reference lines

- Body-Based Pivots: Uses candle body extremes rather than wicks for cleaner structure

📊 Interim High/Low Detection

Separate SL/TP Calculation Framework:

- Independent Pivot Detection: Dedicated left and right bar parameters for stop loss reference

- Interim Left Bars: Lookback for identifying recent swing extremes

- Interim Right Bars: Confirmation period for interim pivot validation

- Last Candle Tracking: Continuously updates most recent opposing candle body levels

- Dual Reference System: Combines interim pivots with last opposing candle for tighter stops

Risk Placement Logic:

- Long trades use last negative bar low (red candle body low) or interim swing low

- Short trades use last positive bar high (green candle body high) or interim swing high

- Provides more reactive stop placement than main swing levels

📈 EMA Trend Confirmation System

Basis Mode:

- Single pair of short and long EMAs for unified trend determination

- Consistent trend reading across both long and short trade directions

- Simplified decision framework with one trend reference

Advanced Mode:

- Dedicated EMA pairs for long trend detection with separate parameters

- Independent EMA pairs for short trend detection with different periods

- Direction-specific validation for enhanced precision

- Greater flexibility in asymmetric market conditions

EMA Exit Trigger Options:

- Intrabar: Exit signal triggers in real-time during bar formation

- Closed Bar: Exit signal only confirmed at bar close for reduced false exits

⚡ Impulsive Candle Detection

Multi-Factor Validation:

- Size Multiplier: Candle range must exceed average true range by adjustable factor

- Volume Multiplier: Trading volume must exceed average volume by configurable threshold

- Body-to-Wick Ratio: Candle body must represent minimum percentage of total range

- Volume Check Toggle: Optional volume validation (disable for crypto tickers with unreliable volume)

Application in Strategy:

- Breakout Validation: Impulsive candles indicate strong momentum behind swing breaks

- Entry Window: Time-limited entry opportunity after impulsive breakout (adjustable bar count)

- Sniper Mode Filter: When enabled, entries only permitted on impulsive candle breakouts

- Visual Highlighting: Orange bar coloring for impulsive candles outside active trades

🎨 Color Customization

- EMA UpTrend Color: Green color for bullish EMA alignment in Basis mode

- EMA DownTrend Color: Red color for bearish EMA alignment in Basis mode

- Swing Line Color: Yellow for interim high/low reference lines

- Stop Loss Color: Red dashed lines showing risk levels

- Take Profit Color: Green dashed lines showing target levels

- Impulsive Candle Color: Orange bar highlighting when impulse detected

🛡️ Risk Management Framework

- Risk/Reward Ratio Configuration: Adjustable profit target multiplier (default 2.2:1)

- Stop Loss Offset Percentage: Buffer applied to interim swing levels for execution safety

- Long Stop Placement: Below last negative bar low or interim swing low with offset

- Short Stop Placement: Above last positive bar high or interim swing high with offset

- Dynamic Target Calculation: Take profit automatically derived from entry and stop distance

- Offset Protection: Prevents stops too close to structure for stop-hunting protection

📊 Detector Decision Filter

Market Condition Filtering:

- Range Mode: Strategy only executes in ranging market conditions

- Trending Mode: Strategy only executes in trending markets (up or down)

- Off Mode: No market condition filter applied (original behavior)

Conditional Execution:

- Swing high/low detection only active when condition matches

- Entry signals only generated when market regime matches selected filter

- Visual swing labels (SH/SL) only displayed during matching conditions

📈 Trend Range Identifier V2

ATR-Based Trend Detection:

- ATR Length: Period for Average True Range calculation in trend analysis

- ATR Multiplier Trend: Multiplier for trend continuation levels (tighter bands)

- ATR Multiplier Reverse: Multiplier for trend reversal levels (wider bands)

- Asymmetric Bands: Different multipliers create adaptive channel width based on trend direction

Range Detection Parameters:

- Range Length: Lookback period for range channel calculation

- Standard Deviation: Multiplier for channel band width

- Channel Type Selection: Choose between Keltner Channel, Bollinger Bands, or Donchian Channel

Supertrend Integration:

- Supertrend Length: Period for Supertrend indicator calculation

- Supertrend Multiplier: ATR multiplier for Supertrend bands

- Crossover Type Selection: Choose price crossover method (close, highlow, reversehighlow, supertrend)

Channel Display Options:

- Yes: Always show channel bands regardless of market condition

- No: Hide channel bands completely

- Range: Only display channel when market is in range condition

📊 Market Regime Classification

Three-State System:

- Trending Up: Price crosses above upper ATR band and maintains upward momentum

- Trending Down: Price crosses below lower ATR band and maintains downward pressure

- Range: Price oscillates between bands without breaking trend thresholds

Trend Logic Framework:

- Accumulative Trend Tracking: Counts consecutive bars in trend for strength measurement

- Line Compression Detection: Range condition identified when bands narrow over lookback period

- Directional Crossover: Trend initiated when price crosses adaptive ATR levels

- Supertrend Confirmation: Optional supertrend-based crossover validation

Visual Indicators:

- UpLine and DownLine: Color-coded step lines (green for uptrend, red for downtrend, purple for range)

- Channel Bands: Teal-colored upper and lower bands with semi-transparent fill

- Candle Coloring: Silver candles during range conditions when showRange enabled

🎯 Entry Signal Generation

Long Entry Requirements:

- Price breaks above last swing high

- Impulsive candle present (if Sniper Mode enabled)

- EMA trend bullish (short EMA above long EMA or long-specific EMAs aligned)

- Within entry window after breakout (adjustable bar count)

- Market condition matches Detector Decision filter

- Mode permits long trades

- Not already in long position (if Conservative mode)

Short Entry Requirements:

- Price breaks below last swing low

- Impulsive candle present (if Sniper Mode enabled)

- EMA trend bearish (short EMA below long EMA or short-specific EMAs aligned)

- Within entry window after breakout

- Market condition matches Detector Decision filter

- Mode permits short trades

- Not already in short position (if Conservative mode)

Breakout Memory System:

- Breakout Tracking: System remembers when swing levels are breached

- Bar Counting: Tracks bars elapsed since breakout for entry window validation

- Breakout Reset: New swing formation invalidates previous breakout signals

- Entry Window Expiration: Breakout must confirm with EMA within specified bar count

📤 Exit Management Logic

Stop Loss Exit:

- Long position: price touches or crosses below calculated stop level

- Short position: price touches or crosses above calculated stop level

- Strategy closes position immediately on stop hit

Take Profit Exit:

- Long position: price reaches calculated target based on risk/reward ratio

- Short position: price reaches calculated target below entry

- Strategy closes position immediately on target hit

EMA Reversal Exit:

- Basis Mode: Short EMA crosses below long EMA (long exit) or above (short exit)

- Advanced Mode: Direction-specific EMA pair crosses against trade direction

- Intrabar Trigger: Exit in real-time when EMA condition met (if selected)

- Closed Bar Trigger: Exit only after bar confirms (if selected)

- Profit/Loss Classification: Exit marked as profit if price favorable to entry, else loss

Position State Management:

- Trade flags reset after exit

- Conservative mode re-enables entries for both directions

- Breakout conditions cleared after exit

- Stop and target lines deleted from chart

🎨 Visualization Features

Entry and Exit Markers:

- Long Entry Arrows: Green triangles below bars

- Short Entry Arrows: Red triangles above bars

- Profit Exit Markers: Dark blue triangles showing successful exits

- Loss Exit Markers: Purple triangles showing stopped trades

Swing Structure Lines:

- Swing High Lines: Yellow dashed horizontal lines with "SH" labels

- Swing Low Lines: Yellow dashed horizontal lines with "SL" labels

- Stop Loss Lines: Red dashed lines extending forward from entry

- Take Profit Lines: Green dashed lines showing target levels

EMA Trend Lines:

- Basis Mode EMAs: Color-coded for trend (green bullish, red bearish)

- Advanced Mode EMAs: Separate long EMAs (green/gray) and short EMAs (red/gray)

- Dynamic Coloring: Gray when EMA pair not in alignment

Trend Range Visualization:

- UpLine/DownLine: Thick step lines showing ATR-based trend levels (green/red/purple)

- Channel Bands: Upper and lower range boundaries with teal fill

- Conditional Display: Channel only shown based on showChannel setting

Trade Candle Coloring:

- Active Long Position: Green candles during long trade

- Active Short Position: Red candles during short trade

- Range Condition: Silver candles when market in range mode

- Impulsive Highlight: Orange bar color when impulsive candle detected outside trades

📈 Strategy Execution Framework

Entry Execution:

- Long Entry: strategy.entry() called when long signal confirms on bar close

- Short Entry: strategy.entry() called when short signal confirms on bar close

- Date Range Validation: Only executes if within backtesting date range

- Bar Confirmation: Uses barstate.isconfirmed to avoid repainting

Exit Execution:

- Position Closure: strategy.close() called on profit, loss, or EMA reversal exits

- Immediate Execution: Exits processed on same bar as exit condition

- Date Range Check: Continues to manage positions even outside date range

- Bar Confirmation: Exits confirmed at bar close for consistency

Position Management:

- Conservative Mode: Blocks new entries until current position closed

- Aggressive Mode: Allows multiple concurrent positions (pyramiding disabled in settings)

- Direction Blocking: Long entry exits shorts, short entry exits longs

- Trade State Tracking: Boolean flags track active position status

🔔 Alert System

- Long entry alerts with ticker and timeframe

- Short entry alerts with ticker and timeframe

- Stop loss hit alerts (combined for both directions)

- Take profit hit alerts (combined for both directions)

- Long EMA exit alerts

- Short EMA exit alerts

- Impulsive candle detection alerts

🔍 Advanced Features[/b>

Dual Swing Detection:

- Primary Swing Detection: Identifies breakout levels for entry signals

- Interim Swing Detection: Separate parameters for tighter stop loss placement

- Independent Configuration: Each detection system uses own left/right bar settings

- Last Candle Fallback: Uses most recent opposing candle if interim pivot not found

Adaptive ATR Bands:

- Directional Multipliers: Different ATR multiples for continuation vs reversal

- Trend Strength Tracking: Accumulative counter measures bars in trend

- Line Compression Logic: Range detected when bands narrow over specified period

- Crossover Flexibility: Multiple price/indicator crossover methods available

Channel Type Variations:

- Keltner Channel: ATR-based bands for volatility-adjusted ranges

- Bollinger Bands: Standard deviation-based statistical boundaries

- Donchian Channel: High/low range extremes for breakout context

- Unified Interface: Same function handles all channel types

Supertrend Integration:

- Direction Variable: Supertrend state (1 or -1) influences trend calculations

- Optional Crossover: Can use supertrend rather than price for trend triggers

- Combined Logic: Supertrend works with ATR bands for robust regime detection

Performance Optimization:

- Process Orders on Close: Prevents lookahead bias in backtesting

- Confirmed Signals Only: Uses barstate.isconfirmed for all entries/exits

- Slippage Modeling: Includes realistic execution costs

- Zero Pyramiding: Prevents position size inflation

✅ Key Takeaways

- Fully Automated Strategy: Complete execution system with entries, stops, and targets

- Dual Swing Framework: Separate detection for breakouts and risk placement

- ATR-Based Regime Filter: Three-state market classification (trending up/down/range)

- Multi-Channel Options: Choose between Keltner, Bollinger, or Donchian for range detection

- Impulsive Candle Filtering: Optional Sniper Mode ensures entries on momentum candles

- Flexible EMA Framework: Basis mode simplicity or Advanced mode direction-specific optimization

- Adaptive Risk Placement: Uses interim swings and last opposing candles for tighter stops

- Entry Window Control: Time-limited opportunity after breakouts prevents late entries

- Market Condition Filtering: Trade only in preferred environments (range, trending, or both)

- Comprehensive Metrics: Built-in performance analysis with PROFABIGHI_CAPITAL library

- Conservative vs Aggressive: Position management adapts to risk preference

- Multi-Exit Logic: Combines fixed targets with dynamic EMA-based exits

- Backtesting Ready: Date range filtering and confirmed signals prevent repainting

- Visual Trade Tracking: Color-coded candles, lines, and markers show complete trade lifecycle

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.