PROTECTED SOURCE SCRIPT

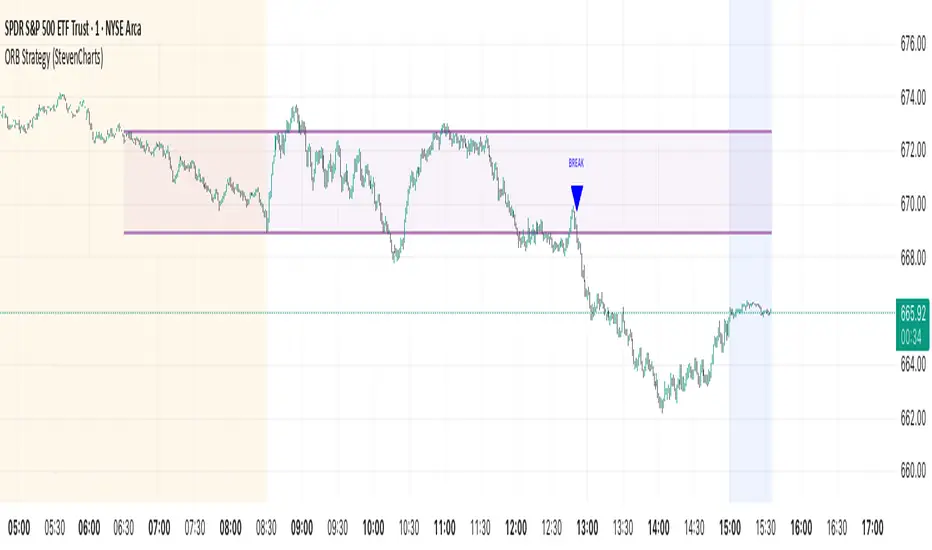

ORB Strategy (StevenCharts)

Summary

This is an advanced Opening Range Breakout (ORB) indicator designed for day traders, particularly those trading US equities and futures.

Its primary feature is the ability to define and monitor two separate opening ranges—typically for Pre-Market and the Market Open. The script can then intelligently merge these two ranges into a single "Combined ORB" if they overlap, providing a cleaner and more unified level of support/resistance to trade from.

Core Features

Dual ORB Sessions: Define two independent, fully customizable time sessions (e.g., a Pre-Market range and a 15-min Market Open range).

Intelligent Combined ORB: If the two ranges overlap, the script automatically merges them into a single, larger "Combined ORB" (using the highest high and lowest low of the two). This provides one clear, consolidated range for analysis.

Advanced Price Action Signals: Breakout signals are not just simple line crosses. The logic checks for specific price action patterns, including:

Breakouts

Fakeouts

Retests

Gap-ups/downs

Signal Invalidation Logic: Breakout signals are automatically invalidated (removed from the chart) if the price retraces back to the 50% midline of the source ORB. This helps filter out failed moves and reduce chart clutter.

Volume Filter: All signals can be filtered by volume. A Vol Multiplier input allows you to require that breakout volume is a certain multiple of the 20-period average volume, helping to confirm conviction.

HOD/LOD Lines: Automatically plots the developing High of Day (HOD) and Low of Day (LOD) with labels, which act as key intraday support and resistance levels.

Built-in Alerts: Alerts are included for all long and short breakout signals.

How It Works

The indicator's logic adapts based on your settings:

Single Range Mode: If you select "Pre-Market" or "Market Open" from the settings, the script will only draw and generate signals from that one selected range.

Dual Range Mode: If you select "Both" and the two defined ranges do not overlap, the script will monitor both ranges independently and generate signals from whichever one is broken.

Combined Range Mode: This is the most powerful feature. If you select "Both" and the ranges do overlap, the script creates a new, single range from the highest high and lowest low of the two. All signals are then based on this new, unified range, and the individual ranges are hidden for clarity.

Main Controls

Show: Choose to display "Pre-Market", "Market Open", or "Both".

Show Combined ORB Only: When "Both" is selected, this toggle enables the intelligent merging logic.

50% Midline: Toggles the visibility of the 50% line for all ORBs. This line is also the invalidation level for signals.

Show HOD/LOD Lines: Toggles the High of Day and Low of Day lines.

ORB Settings

Pre-Market Session (EST): Set the start and end time for the first ORB.

Market Open Session (EST): Set the start and end time for the second ORB.

Colors: Full color customization for all three ranges (Pre-Market, Market Open, and Combined).

Breakout Signal Settings

Show: Toggle the "BREAK" signals on or off.

Vol Multiplier: Set the volume filter threshold. A value of 0 turns the filter off. A value of 1.5 means volume must be 1.5x the average.

Breakout Color: Set the color for the signal labels.

This is an advanced Opening Range Breakout (ORB) indicator designed for day traders, particularly those trading US equities and futures.

Its primary feature is the ability to define and monitor two separate opening ranges—typically for Pre-Market and the Market Open. The script can then intelligently merge these two ranges into a single "Combined ORB" if they overlap, providing a cleaner and more unified level of support/resistance to trade from.

Core Features

Dual ORB Sessions: Define two independent, fully customizable time sessions (e.g., a Pre-Market range and a 15-min Market Open range).

Intelligent Combined ORB: If the two ranges overlap, the script automatically merges them into a single, larger "Combined ORB" (using the highest high and lowest low of the two). This provides one clear, consolidated range for analysis.

Advanced Price Action Signals: Breakout signals are not just simple line crosses. The logic checks for specific price action patterns, including:

Breakouts

Fakeouts

Retests

Gap-ups/downs

Signal Invalidation Logic: Breakout signals are automatically invalidated (removed from the chart) if the price retraces back to the 50% midline of the source ORB. This helps filter out failed moves and reduce chart clutter.

Volume Filter: All signals can be filtered by volume. A Vol Multiplier input allows you to require that breakout volume is a certain multiple of the 20-period average volume, helping to confirm conviction.

HOD/LOD Lines: Automatically plots the developing High of Day (HOD) and Low of Day (LOD) with labels, which act as key intraday support and resistance levels.

Built-in Alerts: Alerts are included for all long and short breakout signals.

How It Works

The indicator's logic adapts based on your settings:

Single Range Mode: If you select "Pre-Market" or "Market Open" from the settings, the script will only draw and generate signals from that one selected range.

Dual Range Mode: If you select "Both" and the two defined ranges do not overlap, the script will monitor both ranges independently and generate signals from whichever one is broken.

Combined Range Mode: This is the most powerful feature. If you select "Both" and the ranges do overlap, the script creates a new, single range from the highest high and lowest low of the two. All signals are then based on this new, unified range, and the individual ranges are hidden for clarity.

Main Controls

Show: Choose to display "Pre-Market", "Market Open", or "Both".

Show Combined ORB Only: When "Both" is selected, this toggle enables the intelligent merging logic.

50% Midline: Toggles the visibility of the 50% line for all ORBs. This line is also the invalidation level for signals.

Show HOD/LOD Lines: Toggles the High of Day and Low of Day lines.

ORB Settings

Pre-Market Session (EST): Set the start and end time for the first ORB.

Market Open Session (EST): Set the start and end time for the second ORB.

Colors: Full color customization for all three ranges (Pre-Market, Market Open, and Combined).

Breakout Signal Settings

Show: Toggle the "BREAK" signals on or off.

Vol Multiplier: Set the volume filter threshold. A value of 0 turns the filter off. A value of 1.5 means volume must be 1.5x the average.

Breakout Color: Set the color for the signal labels.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.