PrimeMomentum 1.1

What Makes PrimeMomentum Unique?

Integration of Multi-Timeframe Data with a Unique Signal Filtering Approach

PrimeMomentum processes data from four timeframes simultaneously, not merely to display trends but to assess the synchronization of momentum across each timeframe. This allows traders to receive signals only when all intervals confirm the direction. This approach minimizes the risk of false signals often encountered with standard tools.

PrimeMomentum analyzes the market across four timeframes:

TF1 (long-term): Displays the overall market direction.

TF2 (medium-term): Refines the current dynamics.

TF3 (short-term): Provides detailed analysis.

TF4 (very short-term): Confirms entry or exit points.

The combination of data from these timeframes allows traders to avoid frequent switching between intervals, simplifying analysis.

Innovative Reversal Logic

PrimeMomentum features a specialized algorithm for identifying trend reversals. Its uniqueness lies in the interaction between dynamic smoothing (EMA) and multi-level momentum assessment, enabling accurate identification of potential trend reversal points.

Dynamic Adaptation to Market Conditions

The indicator automatically adjusts smoothing parameters and threshold values based on market volatility. This enables it to adapt effectively to both calm and volatile markets.

Signals for entering Long or Short positions are generated only when the following conditions are met:

- Momentum shifts from negative to positive (for Long) or from positive to negative (for Short).

- Dynamic smoothing confirms the trend.

- Defined thresholds are reached.

Trend Strength Assessment

Unlike traditional indicators, PrimeMomentum evaluates not only the direction but also the strength of a trend by analyzing the relationship between momentum across each timeframe. This helps traders understand how stable the current market movement is.

The indicator analyzes price changes over a specific period, determining how much current prices deviate from previous ones. This data allows for assessing the strength of market movements.

Combination of Classic Elements with Proprietary Logic

While PrimeMomentum may utilize some widely known components like EMA, its algorithm is built on proprietary logic for evaluating market conditions. This sets it apart from standard solutions that merely display basic indicators without deeper analysis.

Added Value of PrimeMomentum

Trend Visualization with Concept Explanations

PrimeMomentum provides traders with clear visual signals, simplifying market analysis. Each element (color, line direction) is based on momentum and trend-smoothing concepts, enabling traders to make decisions quickly.

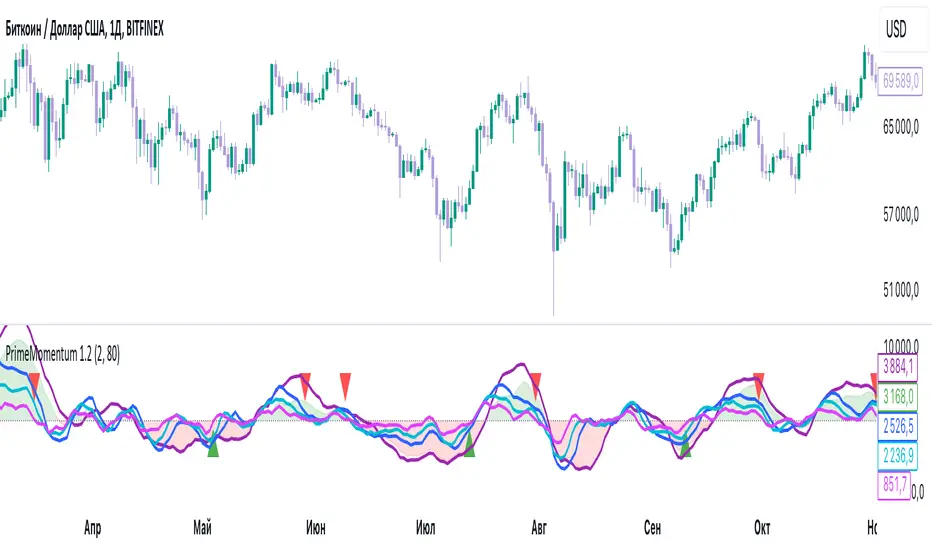

Results are displayed as color-coded lines:

- Dark violet: Long-term trend.

- Blue: Medium-term trend.

- Turquoise and light blue: Short-term trends.

If all momentum lines reach a peak and begin turning downward, it may indicate an approaching bearish trend.

If all lines reach a bottom and start turning upward, it may signal the beginning of a bullish trend.

Reversals can also serve as signals for exiting positions.

MoneyFlow

The PrimeMomentum indicator includes a visualization of MoneyFlow, allowing traders to assess capital flows within the selected timeframe. This functionality helps to analyze market trends more accurately and make well-informed decisions.

MoneyFlow Features:

Dynamic MoneyFlow Visualization:

MoneyFlow is displayed as an area that changes color based on its value:

- Green (with transparency) when MoneyFlow is above zero (positive flow).

- Red (with transparency) when MoneyFlow is below zero (negative flow).

Automatic Scaling:

MoneyFlow values automatically adjust to the chart’s scale to ensure visibility alongside the Momentum lines.

Double Smoothing:

To ensure a smoother and more representation, MoneyFlow uses double smoothing based on EMA.

Customizable Colors and Transparency:

Traders can customize the colors for positive and negative MoneyFlow and adjust the transparency level to fit their preferences.

How MoneyFlow Works:

- MoneyFlow calculations are based on the MFI (Money Flow Index), which considers both price and volume.

- MoneyFlow values are integrated into the overall PrimeMomentum chart and combined with other signals for deeper analysis.

Advantages of the New Functionality:

- Helps quickly identify capital flows into or out of the market.

- Complements Momentum analysis to provide a more comprehensive view of market conditions.

- Enhances decision-making efficiency through flexible visualization settings.

Note: MoneyFlow adapts to the selected timeframe and displays data corresponding to the current interval on the price chart.

Simplicity for Beginners and Depth for Professionals

The indicator is designed to be user-friendly for traders of all experience levels. Beginners benefit from intuitive signals, while experienced traders can leverage in-depth analysis for more complex strategies.

PrimeMomentum Usage Modes

PrimeMomentum adapts to various strategies and supports three modes:

Short-term: Recommended to use a 2H timeframe. Optimal for intraday trading with small TakeProfit levels.

Medium-term: Recommended to use a 1D timeframe for trades lasting several days.

Long-term: Use the 1W timeframe for analyzing global trends.

Support for Different Strategies

Thanks to its flexible settings and support for multiple timeframes, PrimeMomentum is suitable for both day trading and long-term analysis.

Why Is PrimeMomentum Worth Your Attention?

Unlike standard indicators, which often rely solely on basic mathematical models or publicly available components, PrimeMomentum offers a comprehensive approach to market analysis. It combines unique momentum assessment algorithms, multi-timeframe analysis, and volatility adaptation. This not only provides traders with signals but also helps them understand the underlying market processes, making it a truly innovative solution.

Disclaimer

The PrimeMomentum indicator is designed to assist traders in market analysis but does not guarantee future profitability. Its use should be combined with traders' own research and informed decision-making.

Skript nur auf Einladung

Ausschließlich Nutzer mit einer Erlaubnis des Autors können Zugriff auf dieses Script erhalten. Sie müssen diese Genehmigung bei dem Autor beantragen. Dies umfasst üblicherweise auch eine Zahlung. Wenn Sie mehr erfahren möchten, dann sehen Sie sich unten die Anweisungen des Autors an oder kontaktieren Sie SetKryptoBalans direkt.

TradingView empfiehlt NICHT, für die Nutzung eines Scripts zu bezahlen, wenn Sie den Autor nicht als vertrauenswürdig halten und verstehen, wie das Script funktioniert. Sie können außerdem auch kostenlose Open-Source-Alternativen in unseren Community-Scripts finden.

Hinweise des Autors

Haftungsausschluss

Skript nur auf Einladung

Ausschließlich Nutzer mit einer Erlaubnis des Autors können Zugriff auf dieses Script erhalten. Sie müssen diese Genehmigung bei dem Autor beantragen. Dies umfasst üblicherweise auch eine Zahlung. Wenn Sie mehr erfahren möchten, dann sehen Sie sich unten die Anweisungen des Autors an oder kontaktieren Sie SetKryptoBalans direkt.

TradingView empfiehlt NICHT, für die Nutzung eines Scripts zu bezahlen, wenn Sie den Autor nicht als vertrauenswürdig halten und verstehen, wie das Script funktioniert. Sie können außerdem auch kostenlose Open-Source-Alternativen in unseren Community-Scripts finden.