PROTECTED SOURCE SCRIPT

Aktualisiert Daily Separator & Killzone marker (L3J)

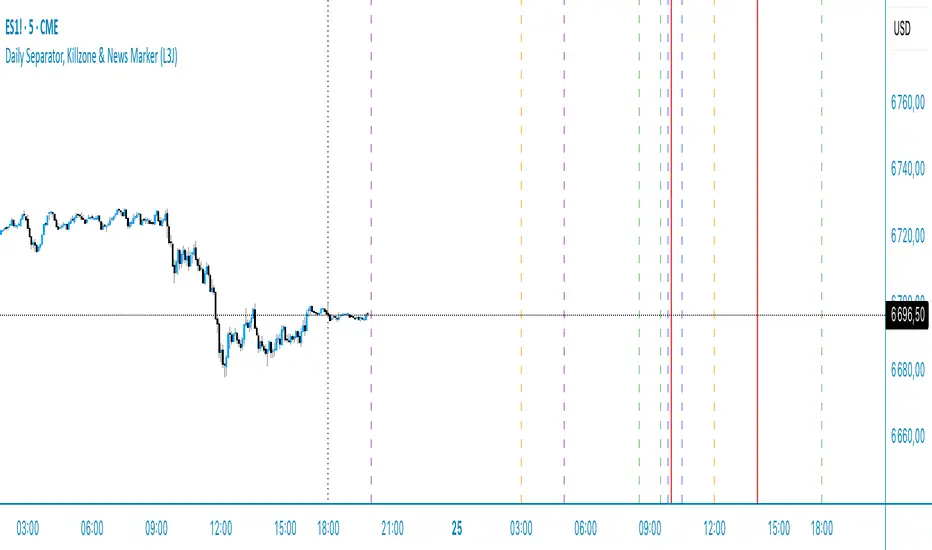

The “Daily Separator (L3J)” is a tool built for day traders who want a clean intraday structure around key U.S. market times and a professional trading-day model. It visually segments trading days, marks critical intraday timestamps (pre-market, cash open, killzone), and aligns with routines inspired by ICT concepts.

Important note: internal code comments and notes are written in French.

What the script does

Day trading strengths (ICT-friendly)

Inputs (end‑user labels in French)

Best practices

Technical notes

If this script helps you structure your sessions better, consider leaving a like and sharing it with other intraday traders.

Happy trading, everyone!

Important note: internal code comments and notes are written in French.

What the script does

- Draws clear, configurable vertical lines to separate each trading day.

- Supports two trading-day models:

- CME 18:00–17:00 (anchored on the Asian session, common for indices/futures)

- Calendar 00:00–23:59 (midnight-to-midnight) - Plots four key intraday rays in UTC‑4:

- 08:30 — U.S. pre-market open

- 09:30 — U.S. cash market open

- 09:50 — killzone start (per my routine)

- 10:30 — killzone end (per my routine) - Smart display logic: each day’s marker stays visible until the time is reached, then auto-hides to keep charts clean.

- Object-budget control: caps the number of historical separators to preserve performance.

Day trading strengths (ICT-friendly)

- Robust CME anchoring: day switches at the Asian session start in UTC‑4, which better reflects U.S. liquidity flow than calendar midnight.

- Focused killzone: highlights 09:50–10:30 for impulse setups, rebalancing, and liquidity events around the open.

- Clean readability: fully customizable colors, styles, and widths; markers auto-remove after their window.

Inputs (end‑user labels in French)

- - Timezone: choose the time zone (default UTC‑4) for session alignment.

- - Day separator:

- Day type: “CME 18:00–17:00” or “Calendrier 00:00–23:59”

- Color, style (solid, dashed, dotted), width

- Max number of visible separators (performance control) - Session (CME): Asian session window used as the anchor (default 18:00–16:00 UTC‑4)

- ndependent intraday markers:

- Pre‑Market Open 08:30

- Market Open 09:30

- Killzone Open 09:50

- Killzone Close 10:30 - - Each with show/hide, color, style, and width settings

Best practices

- U.S. indices (

ES1! ,

NQ1! ) and U.S. equities: favor the “CME 18:00–17:00” mode for a more liquidity‑centric read.

- ICT day trading: form directional bias around 09:30, execute between 09:50–10:30 as initial volatility structures.

- Multi‑timeframe use: keep it on execution charts (1–5 min) and context charts (15–60 min) for time alignment.

Technical notes

- Created by L3J.

- Pine Script v6, overlay=true, controlled object budget.

- Deterministic time calculations via Pine built‑ins.

- All times are expressed in UTC‑4 to align with U.S. practice; adjust the timezone input as needed.

- - Internal code comments/notes are written in French.

If this script helps you structure your sessions better, consider leaving a like and sharing it with other intraday traders.

Happy trading, everyone!

Versionshinweise

Daily Separator, Sessions, Killzone, & News Marker (L3J)Overview

The "Daily Separator, Sessions, Killzone, & News Marker (L3J)" is a comprehensive Pine Script indicator designed for professional futures indices trading. Originally developed as a simple daily separator tool, this script has evolved into a complete trading toolkit that visually organizes trading sessions, key market times, and important news events. Created by L3J, this indicator provides traders with essential temporal reference points for enhanced market analysis and decision-making.

Major New Features

🌏 Global Trading Sessions

- Asia Market Open (20:00 UTC-4) - Orange colored lines marking Asian session start

- Asia Market Close (05:00 UTC-4) - Corresponding session end markers

- London Market Open (03:00 UTC-4) - Blue colored lines for European session

- London Market Close (12:00 UTC-4) - European session end markers

- New York Pre-Market Open (08:30 UTC-4) - Green colored pre-market indicators

- New York Market Open (09:30 UTC-4) - Main US market session start

- New York Close (17:00 UTC-4) - US market session end

⚡ Customizable Killzones

- User-defined time ranges - Set your own killzone start and end times (format HH:MM)

- Killzone Open markers - Visual indicators for strategy entry windows

- Killzone Close markers - Clear exit or evaluation points

- Independent styling - Separate color, style, and width controls for open/close lines

- Default settings - Pre-configured for 09:50-10:30 (common ICT killzone)

📰 Dynamic News Lines System

- Configurable quantity - Choose 1-10 news lines based on your needs

- Custom timing - Set specific times for each news event (HH:MM format)

- Event planning - Pre-mark important economic releases or announcements

- Visual distinction - Orange colored lines with customizable styling

- Smart visibility - Lines appear at 18:00 cycle start and disappear after event time

🕰️ Advanced Trading Cycle Management

- 18:00 UTC-4 cycle start - All lines appear immediately when new trading day begins

- Automatic line removal - Lines disappear precisely when their time is reached

- Cross-midnight handling - Intelligent management of lines spanning calendar days

- Trading day alignment - Follows CME convention (18:00 today to 17:00 tomorrow)

Core Features (Enhanced)

📅 Daily Separators

- CME trading schedule - 18:00-17:00 cycle (industry standard)

- Calendar day mode - Traditional 00:00-23:59 for alternative workflows

- Visual customization - Color, style (solid/dotted/dashed), and width controls

- Resource management - Configurable number of visible separators (1-30)

🎨 Color-Coded System

- Orange - Asia sessions and News events

- Blue - London/European sessions

- Green - New York/US sessions

- Red - Killzones (user-defined)

- Black - Daily separators (customizable)

Technical Improvements

🔧 Interface Enhancements

- English language interface - All parameters translated from original French

- Logical grouping - Parameters organized by session/function for clarity

- Consistent naming - Standardized parameter labels across all features

- Intuitive defaults - Sensible default values for immediate usability

⚙️ Performance Optimizations

- Smart timestamp calculation - Efficient handling of timezone conversions

- Memory management - Proper cleanup of expired lines and arrays

- Resource limits - Bounded object creation to prevent platform issues

- Cycle-aware rendering - Lines only created when needed in current cycle

🛡️ Robust Error Handling

- Time format validation - Comprehensive checking of HH:MM input format

- Range validation - Hours (0-23) and minutes (0-59) boundary checking

- Graceful degradation - Script continues functioning even with invalid inputs

- Clear error messages - Descriptive feedback for troubleshooting

Usage Guide

Initial Setup

1. Enable desired features - Turn on sessions, killzones, or news lines as needed

2. Configure timezone - Verify UTC-4 setting matches your trading requirements

3. Customize colors - Adjust visual appearance to match your chart theme

Session Configuration

- Each major trading session has independent show/hide controls

- Customize colors, line styles, and widths for each session

- Sessions automatically respect the 18:00-17:00 trading cycle

Killzone Setup

1. Set custom times - Enter start and end times in HH:MM format

2. Style open/close lines - Configure visual appearance independently

3. Monitor effectiveness - Lines help identify high-probability trading windows

News Events Planning

1. Enable news system - Turn on news lines feature

2. Set quantity - Choose how many news events to track (1-10)

3. Configure times - Enter specific event times in HH:MM format

4. Plan strategy - Use lines to prepare for market-moving events

Integration

This enhanced script maintains full compatibility with other L3J indicators while providing expanded functionality. The color-coded system helps distinguish between different types of market events, making it an ideal foundation for comprehensive trading analysis.

Security & Performance

- No external data sources - All functionality uses built-in Pine Script features

- Bounded resource usage - Object counts managed to prevent platform issues

- Deterministic calculations - Time-based computations are reliable and consistent

- Memory efficient - Arrays and objects properly cleaned up to prevent leaks

Version History

- Original Version: Basic daily separator with French interface

- Current Version: Comprehensive trading toolkit with global sessions, customizable killzones, news events, and English interface

This script is specifically designed for futures indices trading and follows professional trading conventions for optimal market analysis.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.