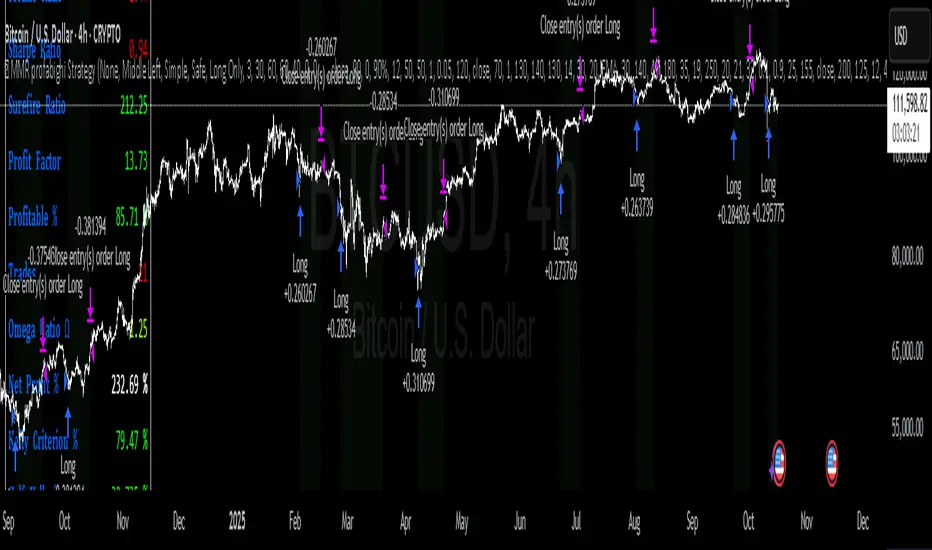

🚀 Multi-Mean-Reversion Strategy -> PROFABIGHI_CAPITAL

The Multi-Mean-Reversion Strategy → PROFABIGHI_CAPITAL is a confluence-driven counter-trend system that leverages market regime analysis, Z-score overextension detection, multi-layered RSI enhancements, and standard deviation bands to pinpoint reversion opportunities. It combines four signal codes with tunable modes (safe or speed) and directional controls, making it ideal for DCA timing by identifying undervalued pullbacks in trending markets for systematic averaging.

⚙️ Strategy Configuration

- Initial Capital: Starting equity for simulation and metric calculation

- Slippage Adjustment: Models trade execution costs for realistic performance

- Position Sizing: Allocates equity percentage per trade for balanced exposure

- Pyramiding Limit: Disabled to maintain single-entry discipline

- Order Timing: Processes on bar close for signal confirmation

- Margin Control: Zero leverage for both long and short positions

📅 Date Range Settings

- Date Filter Toggle: Enable to confine backtesting to selected periods

- Start Date Input: Defines the beginning for trade and analysis scope

- Range Enforcement: Limits new entries to within the timeframe

- Full History Option: Disables filter for complete dataset evaluation

📊 System Metrics Display

Performance Curve Choices:

- Strategy View: Overall execution path including open trades

- Equity Growth: Capital progression from closed positions

- Open Profit Overlay: Real-time unrealized performance

- Gross Profit Line: Total wins before deductions

- Net Profit Curve: Final returns after all costs

- Hidden Option: Removes curve for cleaner chart focus

Table Customization:

- Position Options: Anchors metrics in chart corners or centers

- Full Analytics: Detailed stats like win rate and drawdown

- Basic Summary: Essential figures such as total return

- No Table: Suppresses display for minimal interface

🎯 Strategy Settings

- Mode Selection: Safe demands full confluence; speed requires 75% for quicker setups

- Direction Preference: Both sides, long-only, or short-only for bias

- Tolerance Window: Bars allowed for signal lag to capture timing

- RSI Entry Thresholds: Oversold/overbought levels for long/short initiations

- RSI Exit Thresholds: Normalization bands for position unwinds

- Stdev Exit Multipliers: Volatility-scaled levels above/below mean for closures

🎛️ Signal Selection Settings

Long Entry Options:

- Code 1 Reversion: Activates regime detector for pullback entries

- Code 2 Oversold: Triggers on Z-score undervaluation extremes

- Code 3 RSI Low: Fires at enhanced RSI oversold readings

- Code 4 Buy Cross: Engages on lower SD band upward breaks

Short Entry Options:

- Code 1 Reversion: Uses regime signals for overextension shorts

- Code 2 Overbought: Alerts on Z-score overvaluation peaks

- Code 3 RSI High: Activates at enhanced RSI overbought

- Code 4 Sell Cross: Triggers on upper SD band downward breaks

Long Exit Options:

- Code 2 Overbought: Closes on valuation mean reversion

- Code 3 RSI Recovery: Exits at RSI normalization upward

- Code 4 Sell Cross: Unwinds on upper band resistance

- Stdev Threshold: Volatility-based stop above mean

Short Exit Options:

- Code 2 Oversold: Closes on downside exhaustion

- Code 3 RSI Rebound: Exits at RSI normalization downward

- Code 4 Buy Cross: Unwinds on lower band support

- Stdev Threshold: Volatility-based stop below mean

📈 Market Regime Detector (Code 1)

ADF Test Setup:

- Source and Sample Length: Price input and window for stationarity

- Lag Inclusion: Serial correlation adjustments

- Confidence Threshold: Critical values for reversion conclusion

- Hull Smoothing: Post-test trend filter

- Normalization Window: Bounds for scaling to -1/+1

Ljung-Box Test Setup:

- Autocorrelation Sample: Period for serial dependence

- Lag Count: Dependence levels tested

- Significance Cutoff: Hypothesis rejection level

- Normalization Period: Scaling for comparability

KPSS Test Setup:

- Unit Root Sample: Data window for trend stationarity

- Variance Lag: Long-run estimation truncation

- Normalization Horizon: Bounds adjustment

Phillips-Perron Test Setup:

- Non-Parametric Sample: Window with variance stabilization

- Hull Smoothing Layer: Trend refinement

- Normalization Span: Scaling period

ADX Setup:

- Trend Strength Smoothing: ADX calculation period

- Directional Length: +DI/-DI horizon

- Derivative Filter: Smoothing method and length

- Normalization Window: Scaling bounds

Choppiness Index Setup:

- Range vs. ATR Period: Consolidation measurement

- Normalization Lookback: Inverse scaling period

Wavelet Transform Setup:

- Haar Decomposition Window: Frequency separation scale

- Post-Transform Smoothing: Hull MA filter

- Normalization Period: Bounds for signal

Price Momentum Setup:

- Change Rate Horizon: Velocity calculation

- Hull Smoothing: Normalized filter

- Normalization Window: Scaling span

GARCH Volatility Setup:

- Model Initialization: Alpha/beta starting values

- EMA Volatility Length: Smoothing base

- Normalization Horizon: Scaling period

Yang Volatility Setup:

- Estimator Sample: Bars for analysis

- Volatility Components: Open-close-high-low integration

- Adaptive Smoothing: Volatility-responsive EMA

- Normalization Window: Bounds adjustment

Oscillator Confluence

- Regime Threshold: Minimum alignment for mean-reversion bias

📊 Z-Score Valuation (Code 2)

Core Functions:

- Rescale Normalization: Maps values to common ranges

- RSI Oscillator: Momentum deviation from equilibrium

- ROC Change Rate: Acceleration Z-score

- BB% Band Position: Volatility envelope placement

- CCI Cyclical Measure: Deviation from typical price

- Crosby Angle Ratio: Trend slope normalization

- Sharpe Efficiency: Annualized return/volatility

- Sortino Downside Focus: Negative deviation penalty

- Omega Gain/Loss Ratio: Probability-weighted outcomes

- Z-Score Core: Standard deviation from historical mean

Relationship Analysis:

- Price Correlations: Linear ties for each indicator

- Beta Sensitivities: Scaling by price impact

Composite Blending:

- Weight Schemes: Adaptive (correlation absolute) or equal

- Price Incorporation: 30% blend for direct alignment

- Fair Value Bands: Mean with ±1/2/3 sigma projections

🧠 Enhanced RSI (Code 3)

Signal Mode Choices:

- Smart Standard: Balanced thresholds for typical reversions

- Speed Trend-Follow: Adjusted levels for directional bias

Weighted RSI Components:

- Weight Basis: Volume, momentum, volatility, or reversion factors

- MA Smoothing Types: SMA to TEMA for delta filtering

- Core and Smoothing Periods: RSI and post-weight averaging

ML RSI Enhancement:

- KNN Activation: Pattern matching toggle

- Neighbor Count: Historical similar points averaged

- Pattern Window: Bars searched for matches

- Feature Dimensions: RSI momentum, std, regression, price mom

- Blend Ratio: ML vs. base RSI influence

Median RSI Filter:

- Price Median Period: Central tendency smoothing

- RSI on Median: Oscillator post-filtering

Composite Weighting:

- Variant Enables: Individual toggles for inclusion

- Proportional Blends: Custom weights auto-normalized

Visual Thresholds:

- Overbought/Oversold: Plotting levels for RSI extremes

📊 SD Bands (Code 4)

- WMA Base Length: Central line smoothing period

- Source Input: Price data for band construction

- Deviation Window: Stdev calculation horizon

📈 Signal Detection & Confirmation

Tolerance Checker:

- Scans recent bars for lagged signal validation

Code 1 Reversion:

- Activates below confluence threshold for regime bias

Code 2 Extremes:

- Flags wick hits on Z-derived over/undervaluation

Code 3 RSI Thresholds:

- Triggers at combined RSI entry/exit levels

Code 4 Band Crosses:

- Detects low/high violations of outer SD levels

Confluence Counters:

- Tallies active signals for mode-based requirements

📈 Entry & Exit Logic

Long Initiation:

- Blends reversion, oversold, RSI low, and buy cross

- Safe: Full match; speed: 75% alignment

Short Initiation:

- Merges reversion, overbought, RSI high, and sell cross

- Safe: Complete set; speed: Majority vote

Long Closure:

- Any of overbought, RSI recovery, sell cross, or stdev stop

Short Closure:

- Any of oversold, RSI rebound, buy cross, or stdev stop

Position Flow:

- Tracks state to prevent overlaps

- Closes opposites on new directions

- Date gates new entries only

🛡️ Risk Management

- Stdev-Based Stops: Mean plus/minus multiplier for volatility exits

- RSI Normalization: Thresholds for mean reversion unwinds

- Extreme Wick Alerts: Overextension triggers via Z-bands

- Signal-Driven Safeguards: Counter-trend closes on band tests

- Equity Proportionality: Fixed percentage risk per setup

📉 Visualization

- Position Tints: Faint green/red backgrounds during trades

- Confluence Dashboard: Real-time signal counts and statuses

- Regime Boundary: Horizontal line at reversion threshold

- Z-Score Channels: Dynamic over/oversold plots on price

- Combined RSI Line: Weighted oscillator for momentum view

- Multi-Level SD Bands: Deviation envelopes for cross alerts

- Top-Right Summary: Mode, direction, signals, and exits overview

🔔 Alert System

- Long entry notifications with ticker and timeframe on confluence

- Short entry notifications with ticker and timeframe on confluence

- Long exit notifications on trigger activation

- Short exit notifications on trigger activation

✅ Key Takeaways

- Signal Fusion Engine: Four codes create layered confluence for reliable reversions

- Mode Adaptability: Safe for precision, speed for volume in varying conditions

- DCA Optimization: Excels at spotting undervalued dips for dollar-cost averaging entries

- Visual Clarity: Tables and colors deliver instant signal and regime insights

- Regime-Smart Trading: Detector filters for true mean-reversion setups

- Backtest Reliability: Gated dates and metrics ensure robust testing

- Balanced Exits: Multiple triggers protect profits without premature closes

Skript nur auf Einladung

Ausschließlich Nutzer mit einer Erlaubnis des Autors können Zugriff auf dieses Script erhalten. Sie müssen diese Genehmigung bei dem Autor beantragen. Dies umfasst üblicherweise auch eine Zahlung. Wenn Sie mehr erfahren möchten, dann sehen Sie sich unten die Anweisungen des Autors an oder kontaktieren Sie PROFABIGHI_CAPITAL direkt.

TradingView empfiehlt NICHT, für die Nutzung eines Scripts zu bezahlen, wenn Sie den Autor nicht als vertrauenswürdig halten und verstehen, wie das Script funktioniert. Sie können außerdem auch kostenlose Open-Source-Alternativen in unseren Community-Scripts finden.

Hinweise des Autors

Haftungsausschluss

Skript nur auf Einladung

Ausschließlich Nutzer mit einer Erlaubnis des Autors können Zugriff auf dieses Script erhalten. Sie müssen diese Genehmigung bei dem Autor beantragen. Dies umfasst üblicherweise auch eine Zahlung. Wenn Sie mehr erfahren möchten, dann sehen Sie sich unten die Anweisungen des Autors an oder kontaktieren Sie PROFABIGHI_CAPITAL direkt.

TradingView empfiehlt NICHT, für die Nutzung eines Scripts zu bezahlen, wenn Sie den Autor nicht als vertrauenswürdig halten und verstehen, wie das Script funktioniert. Sie können außerdem auch kostenlose Open-Source-Alternativen in unseren Community-Scripts finden.