PROTECTED SOURCE SCRIPT

Aktualisiert ICT Concepts [SB]

ICT Market Structure Shift (MSS) Alert Indicator

This indicator identifies Market Structure Shifts (MSS) based on ICT concepts, helping traders spot key reversal or continuation points in price action.

Features:

✅ Detects bullish and bearish MSS using swing highs and swing lows.

✅ Customizable lookback period to fine-tune structure identification.

✅ Alerts for confirmed MSS when price breaks structure with momentum.

✅ Option to filter MSS by higher timeframe bias for confluence.

✅ Highlights liquidity sweeps before a shift to confirm smart money activity.

✅ Works on all timeframes and asset classes, including Forex, Stocks, Crypto, and Futures.

How It Works:

Bullish MSS: Occurs when price breaks above a recent swing high after taking out a previous swing low (liquidity grab).

Bearish MSS: Occurs when price breaks below a recent swing low after taking out a previous swing high.

Can be used standalone or combined with FVGs, Order Blocks, and Premium/Discount zones for high-probability setups.

Best Usage:

Scalping: 1m–5m timeframe for intraday reversals.

Intraday Trading: 15m–1H for session-based structure shifts.

Swing Trading: 4H–Daily for macro trend reversals.

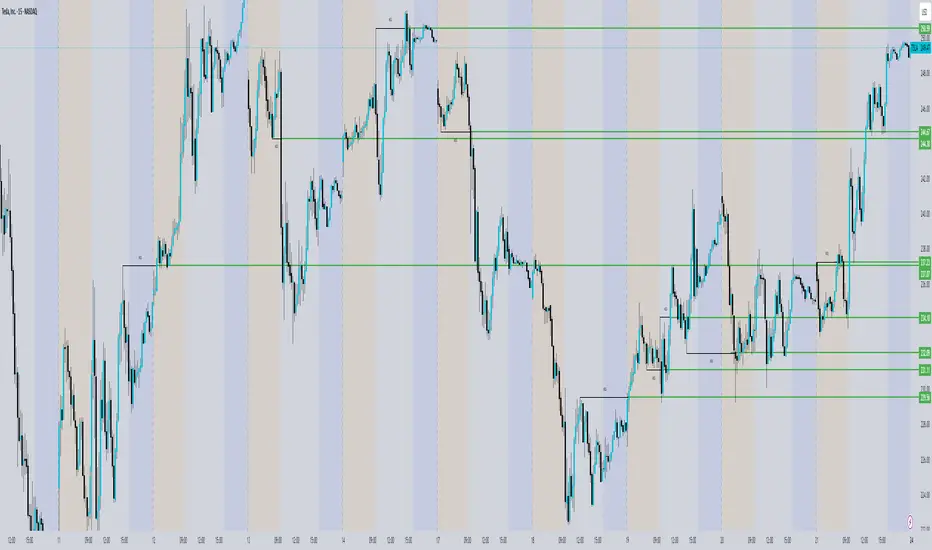

Look for retest of MSS for entries after they fail as appears in chart highlighted by green horizontal lines or FVG to support after shifts.

Perfect for traders who use ICT, Smart Money Concepts (SMC), and Market Structure-based strategies.

This indicator identifies Market Structure Shifts (MSS) based on ICT concepts, helping traders spot key reversal or continuation points in price action.

Features:

✅ Detects bullish and bearish MSS using swing highs and swing lows.

✅ Customizable lookback period to fine-tune structure identification.

✅ Alerts for confirmed MSS when price breaks structure with momentum.

✅ Option to filter MSS by higher timeframe bias for confluence.

✅ Highlights liquidity sweeps before a shift to confirm smart money activity.

✅ Works on all timeframes and asset classes, including Forex, Stocks, Crypto, and Futures.

How It Works:

Bullish MSS: Occurs when price breaks above a recent swing high after taking out a previous swing low (liquidity grab).

Bearish MSS: Occurs when price breaks below a recent swing low after taking out a previous swing high.

Can be used standalone or combined with FVGs, Order Blocks, and Premium/Discount zones for high-probability setups.

Best Usage:

Scalping: 1m–5m timeframe for intraday reversals.

Intraday Trading: 15m–1H for session-based structure shifts.

Swing Trading: 4H–Daily for macro trend reversals.

Look for retest of MSS for entries after they fail as appears in chart highlighted by green horizontal lines or FVG to support after shifts.

Perfect for traders who use ICT, Smart Money Concepts (SMC), and Market Structure-based strategies.

Versionshinweise

ICT Market Structure Shift (MSS) & Break of Structure (BOS) Alert IndicatorThis advanced indicator is designed to help traders identify Market Structure Shifts (MSS) and Breaks of Structure (BOS) based on ICT (Inner Circle Trader) concepts. It highlights key reversal and continuation points, ensuring traders stay aligned with smart money movements.

Features:

✅ Identifies Bullish & Bearish MSS using swing highs and swing lows.

✅ Includes BOS Detection for confirmed trend shifts and continuation setups.

✅ Customizable Lookback Period to refine structure identification.

✅ Alerts for Confirmed MSS/BOS when price breaks structure with momentum.

✅ Higher Timeframe Bias Filter for added confluence.

✅ Liquidity Sweep Detection to confirm smart money participation.

✅ Works on All Timeframes & Asset Classes, including Forex, Stocks, Crypto, and Futures.

How It Works:

Bullish MSS: Price breaks above a recent swing high after grabbing liquidity from a previous swing low.

Bearish MSS: Price breaks below a recent swing low after grabbing liquidity from a previous swing high.

Break of Structure (BOS): Confirms trend continuation after an MSS, signaling stronger directional bias.

Best Usage:

🔹 Scalping: 1m–5m for intraday reversals.

🔹 Intraday Trading: 15m–1H for session-based structure shifts.

🔹 Swing Trading: 4H–Daily for macro trend reversals.

Traders can use this indicator standalone or combine it with Fair Value Gaps (FVGs), Order Blocks (OBs), and Premium/Discount Zones for high-probability setups. Ideal for ICT, Smart Money Concepts (SMC), and Market Structure-based strategies.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.